- Bitcoin holds key support at $83.3K, with bullish potential if it reclaims the STH realized price at $90.57K.

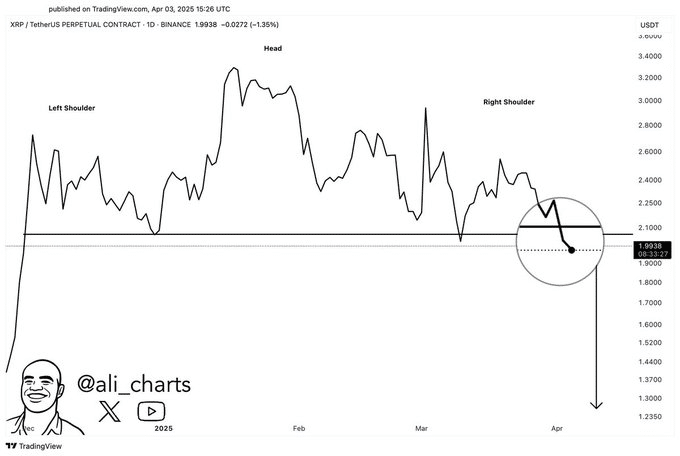

- XRP shows weakness, forming a bearish head-and-shoulders pattern that could trigger a 37% drop.

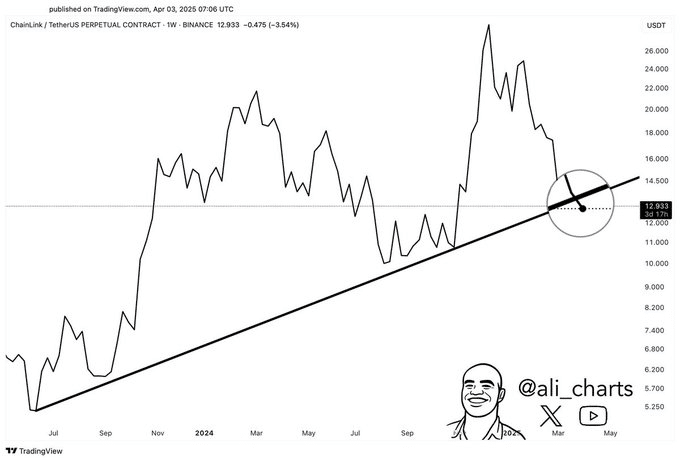

- Chainlink under pressure, testing a critical ascending trendline that has supported its uptrend since July 2023.

Prominent crypto analyst and trader Ali Martinez has shared his latest market outlook, offering cautious advice on XRP, Bitcoin, and Chainlink. With his extensive following of 134,800 on social media platform X, Martinez’s insights are sparking discussions in the crypto community, especially as he anticipates potential shifts in the market.

Martinez has expressed a bearish stance on XRP (XRP), the fourth-largest cryptocurrency by market cap. According to the analyst, XRP may face a significant decline of around 37% from its current price level. This prediction comes after XRP formed a classic head-and-shoulders pattern on its daily chart.

Source: X

The head-and-shoulders pattern is a technical indicator often seen as a signal of a bearish reversal. It suggests that the asset has lost its bullish momentum and is struggling to break new highs, with the right shoulder failing to mirror the left shoulder’s peak. Martinez notes that this pattern could spell trouble for XRP’s price action in the short term.

At the time of writing, XRP price is $2.16 with a 24-hour trading volume of $4,417,719,562. XRP is up 6.88% in the last 24 hours. but Martinez’s outlook indicates that the altcoin could tumble further if the pattern plays out as expected.

Bitcoin’s Bullish Potential Hinges on Key Level

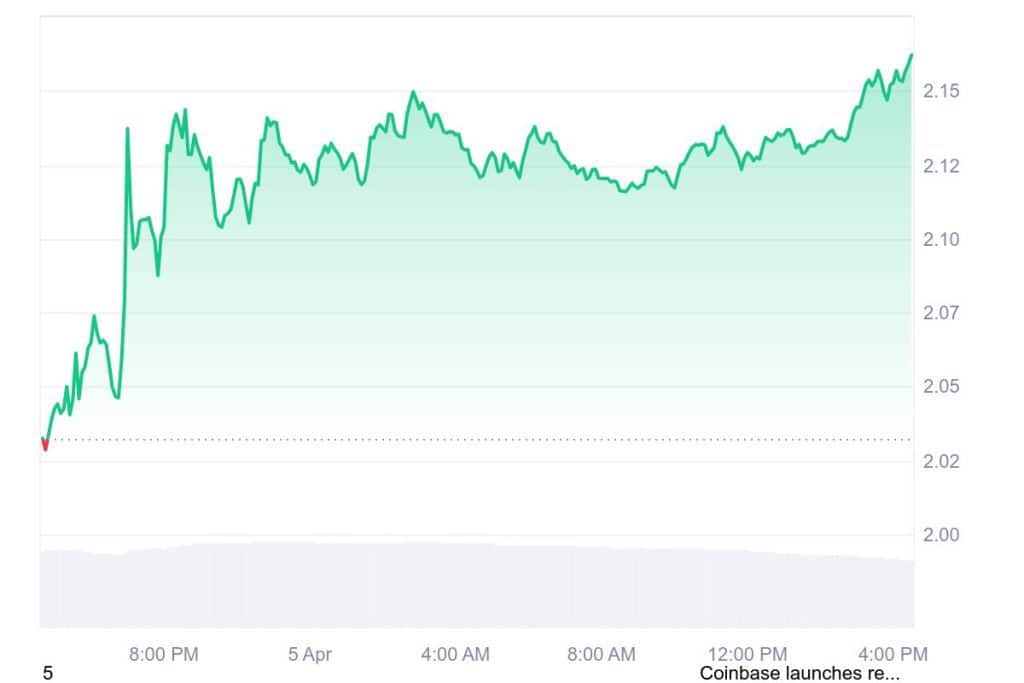

Turning his focus to Bitcoin (BTC), Martinez is observing critical signals that could determine whether the leading cryptocurrency will resume its bullish trajectory. According to the analyst, Bitcoin has a chance to flip bullish if it can successfully retest a key price level as support.

Martinez is particularly focused on Bitcoin’s short-term holder (STH) realized price, which tracks the average price at which coins are acquired by holders who have held their assets for 155 days or less. He emphasizes that the first real indication of Bitcoin’s potential to begin a new bull run would be if the asset manages to reclaim the STH realized price at $90,570.

The first signal that #Bitcoin $BTC is ready to resume its bull run is reclaiming the short-term holder realized price at $90,570! pic.twitter.com/nkdsG8AcGX

— Ali (@ali_charts) April 4, 2025

As of now, Bitcoin price is $83,533.74 USD with a 24-hour trading volume of $32,785,532,040 USD. Bitcoin is up 1.66% in the last 24 hours.. With this gap still in play, Martinez is keeping a close watch on how the market responds to this critical threshold.

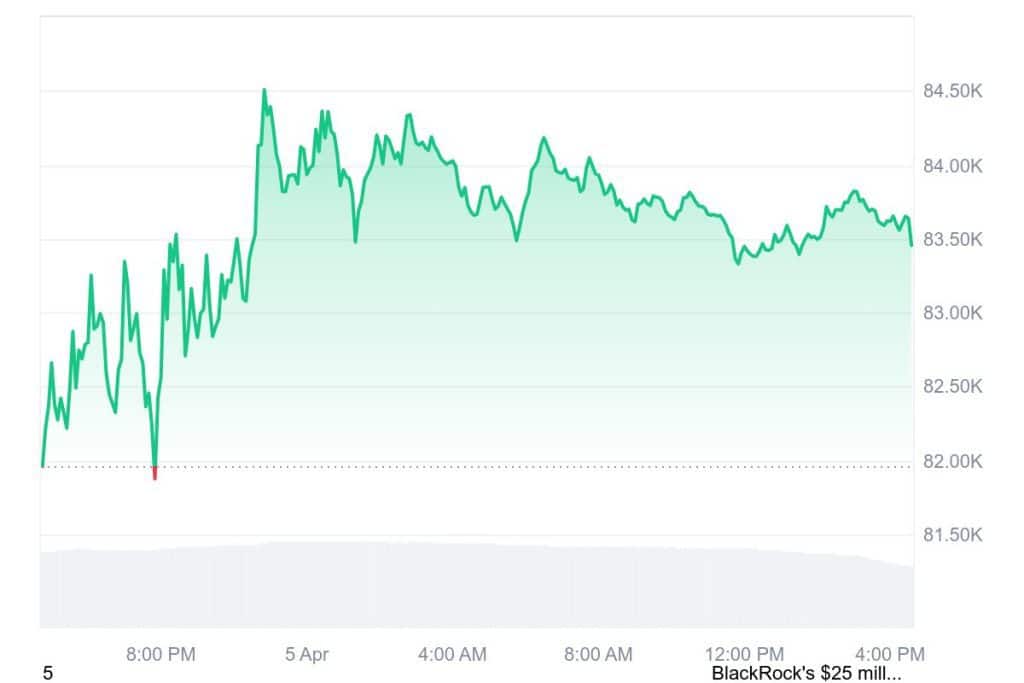

Profit-Taking Signals in Bitcoin Market

In addition to his outlook on Bitcoin’s potential bullish movement, Martinez has also noticed signs of profit-taking in the market. He points to the increased activity of long-term holders, who have been moving substantial amounts of BTC to exchanges. Data from the blockchain analytics platform CryptoQuant reveals that over 1,058 BTC, worth more than $88 million at current prices, were moved by long-term holders in just a single day.

Long-term holders moved over 1,058 #Bitcoin $BTC yesterday! Signs of profit-taking as older coins return to the market. pic.twitter.com/WdbuGVITXa

— Ali (@ali_charts) April 4, 2025

Long-term holders are defined as entities that have kept their coins inactive for over 155 days. This influx of long-held Bitcoin moving to exchanges suggests that some investors may be looking to cash out, a signal that could have implications for Bitcoin’s price stability.

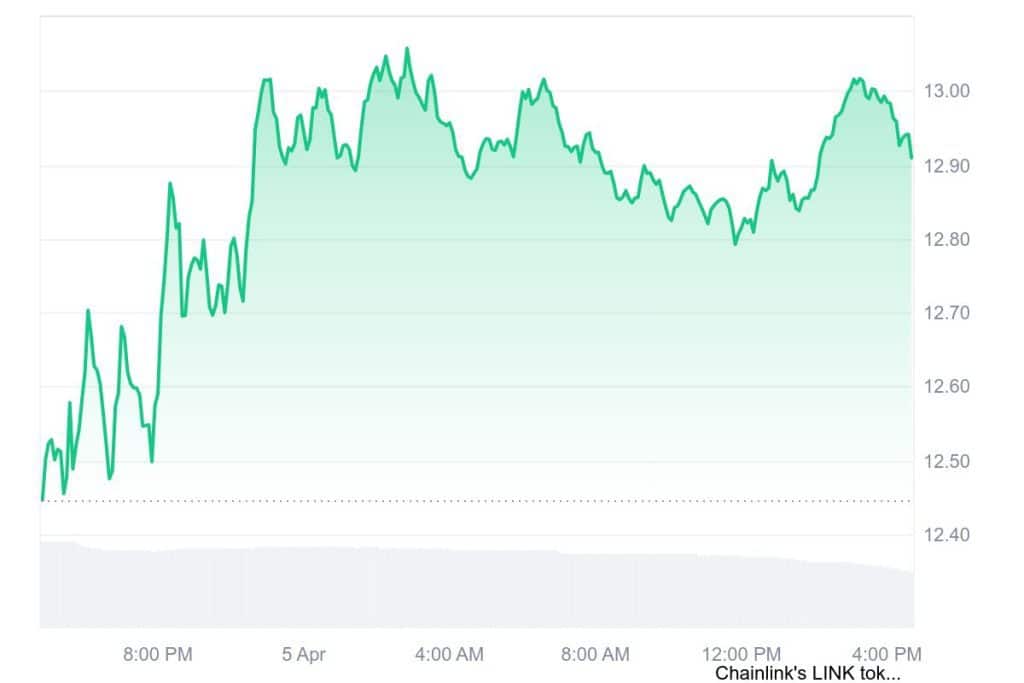

Finally, Martinez is sounding the alarm for Chainlink (LINK), as the altcoin tests an important ascending trendline on its weekly chart. This trendline has supported LINK’s bullish momentum since July 2023. However, with Chainlink now approaching this trendline, Martinez suggests that if the asset fails to maintain this support, it could turn bearish.

At the time of writing, Chainlink price is $12.91 USD with a 24-hour trading volume of $331,768,794 USD. Chainlink is up 3.60% in the last 24 hours, and Martinez believes that its price action could shift drastically if it breaks below this key trendline. Traders and investors are closely monitoring this technical level, as a breach could signal the end of Chainlink’s current upward trajectory.

Related | Bitcoin gains momentum as Arthur Hayes supports Trump’s Tariffs

How would you rate your experience?