- Bitcoin mining revenue hit $3.7B in Q4 2024, up 42% from Q3.

- Miners upgrade hardware and explore new revenue streams.

- Bitcoin is shifting toward a long-term store of value.

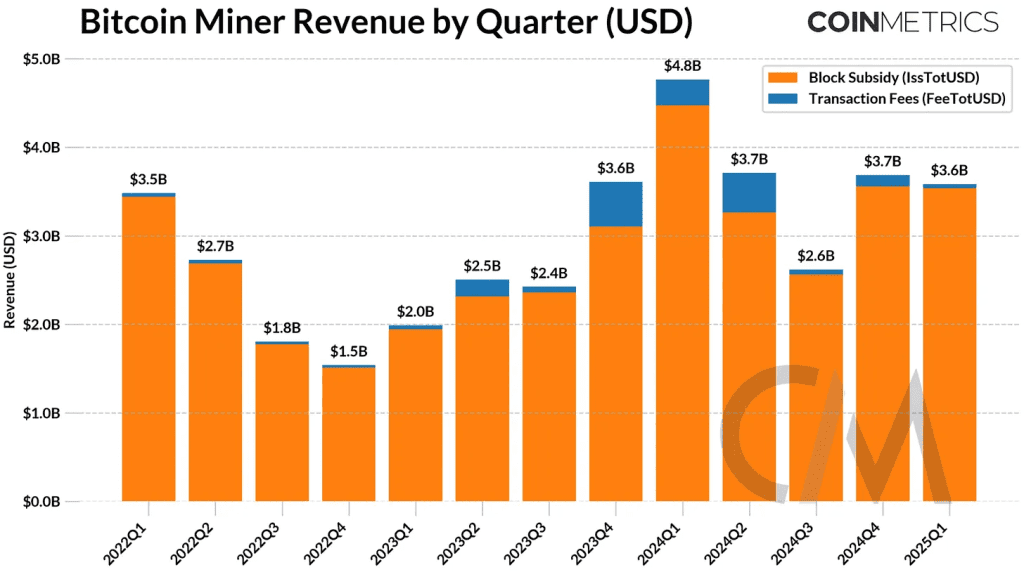

Bitcoin miners recorded a revenue of $3.7 billion in the fourth quarter of 2024. This marked a sharp 42% rise from the previous quarter. The increase came despite the impact of the Bitcoin halving event that reduced block rewards.

Miner revenue in the first quarter of 2025 remains high at around $3.6 billion. Higher mining revenue is due to Bitcoin’s increasing price and utilization of efficient mining hardware. Transaction fees still represent a minimal portion, at just 1.33% of the total revenue.

Meanwhile, the Bitcoin network’s total hashrate has reached 807 EH/s, reflecting stable mining. Miners are altering their strategies to maintain profitability. The majority of them are adopting energy-efficient mining hardware.

Others are moving to areas where there is cheaper electricity, such as Texas wind farms or new markets with unused power resources. Some miners also are making the shift to AI data center hosting to create new revenue streams.

Hardware Dominance and Geopolitical Risks

Mining relies on the utilization of some specific hardware called ASICs. The majority of ASICs utilized for Bitcoin mining are manufactured by China-based Bitmain. The estimates suggest that 59% to 76% of the total hashrate of the network is represented by Bitmain’s machines.

This reliance on a single company is precarious. In early 2025, shipments from some U.S. miners were delayed by increased customs inspections and new tariffs on Chinese imports. This has increased supply chain stability fears. If geopolitical tensions continue, mining operations could face further disruption.

Despite these risks, miners are attempting to diversify supply chains. More companies are looking at other hardware providers to reduce exposure to Bitmain. Some also plan to manufacture ASICs in other nations so as to gain a stable supply of mining equipment.

Bitcoin’s Growing Role as a Digital Asset

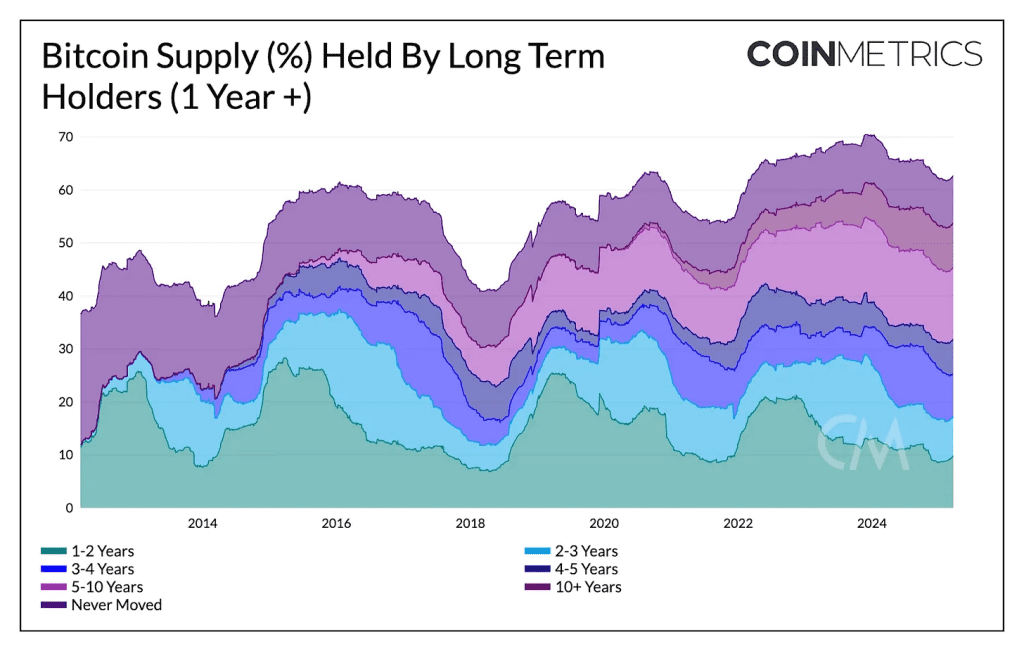

Bitcoin was originally meant for online transactions, but that is shifting. On-chain indicators are pointing to it being more considered as a store of value rather than a means of exchange. Institutions and public firms are now holding on to more Bitcoin, and large players have custody of over 14% of its overall supply.

Transaction data supports this trend. Small transactions of under $100 represent about 60% of all Bitcoin transactions. Meanwhile, high-value transactions of $100,000 to $1 million have risen but represent a lower proportion of total transactions.

The long-term holders are increasing. 63% of Bitcoin’s total supply has now been held for over a year. This increasing trend indicates that increasingly more investors are holding Bitcoin as an asset for the long term and not utilizing it for daily transactions.

Related Reading: Bitcoin Liquidity Trends: Will March or April See the Surge?

How would you rate your experience?