- Bitcoin holds steady above $110,000 with small daily and weekly gains.

- Current correction aligns with past bull market patterns.

- Market metrics show 90% of supply in profit, a critical signal point.

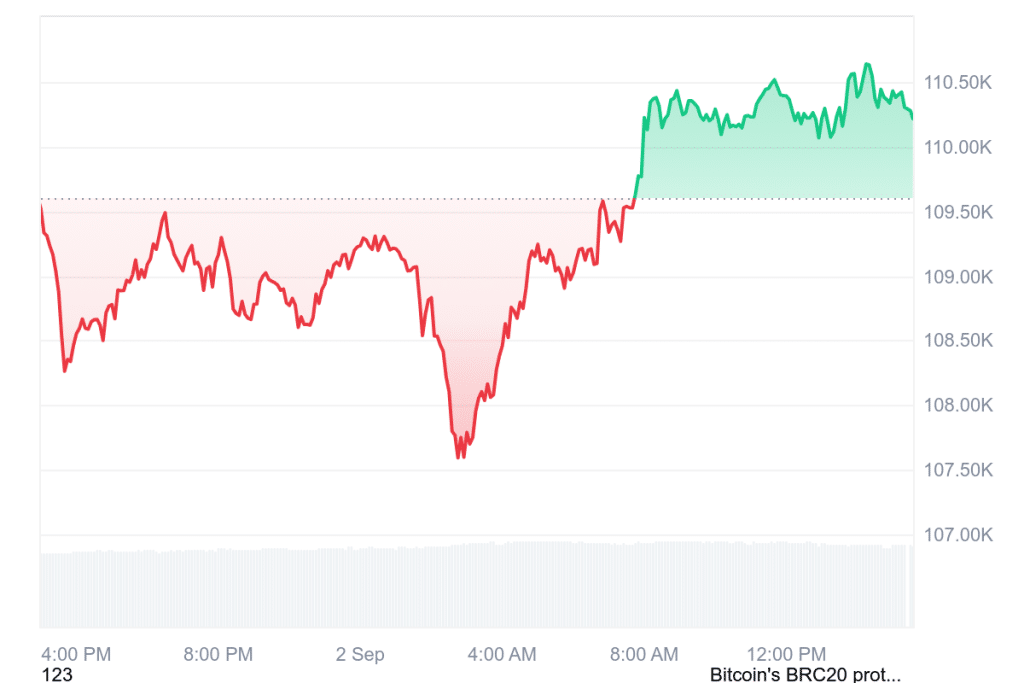

Bitcoin is currently trading at $110,607.81, marking a daily rise of 0.81%. Over the past week, the cryptocurrency posted a modest 0.17% increase, holding its value close to the $110,580.96 level. Despite small gains, traders continue to focus on the broader correction underway since Bitcoin’s last peak.

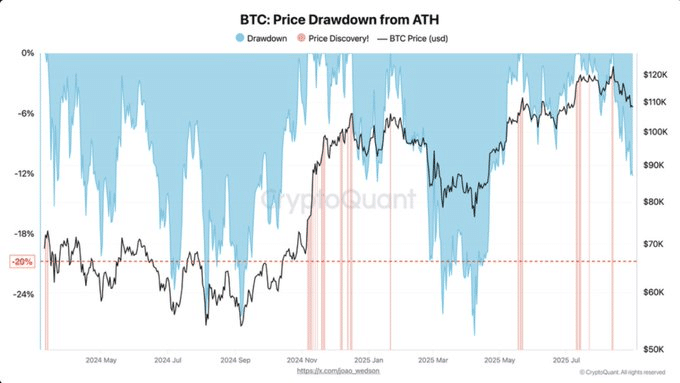

CryptoQuant’s Analyst took to Twitter and stated that, The last all-time high was approximately $123,000. Bitcoin has since corrected approximately 12% back down from that level. Such a correction is still within historical bull market parameters, analysts claim. Bitcoin’s largest correction since March 2024, when this cycle initially made a new all-time high, was 28%.

Typical retracements have ranged between 20% and 25%, holding this recent decline within typical bounds. It is considered a cooling-off period rather than a shift in trend by market watchers. Corrections usually unwind leverage in derivative markets, temper hot sentiment in trading, and present long-term investors with new entry points.

Bitcoin Corrections Stay Within Bull Cycle Range

Data from recent cycles shows Bitcoin rarely sees corrections below 28% during bull cycles. That has continued this cycle. Traders who can recall previous drawdowns understand that retracements often provide better bases upon which to build the next wave’s momentum.

Latest 12% decline demonstrates a healthy correction rather than a reversal. Dramatic falls within previous bull markets made new investors nervous but subsequently put the market in a position to continue growing. It appears this cycle is repeating at a similar pace.

Bitcoin’s value remaining firm above $110,000 levels is an indication of consistent demand. Institutional and retail investors continue to monitor supply dynamics, an area which continues to be a major indicator for upcoming months.

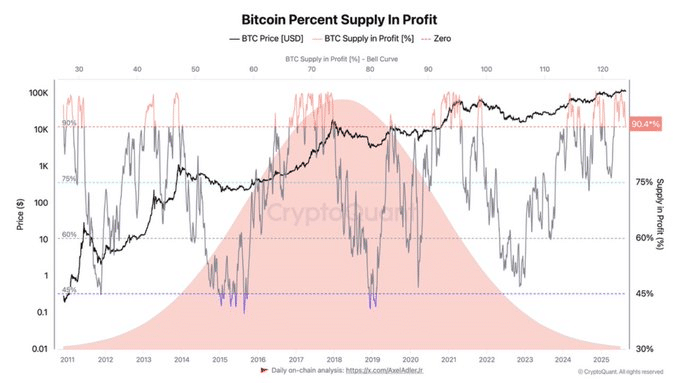

Traders Eye Market Direction After 90% Profit Signal

On August 28, Analysts CryptoQuant indicated another key sign on August 28. Bitcoin’s share of supply in profit has now reached 90%. This threshold has been a historically key determinant of market direction. Typical historical levels have witnessed about 75% of supply be in profit since Bitcoin’s inception. Bull cycles usually drive this level to or above 90%.

Once below that level again, it will correct. But on bear markets, supply in profit will be less than 50%, usually signifying bottoms. A reading this high at 90% suggests this market is at a juncture.

Although volatility may be magnified by intense profit-taking, it can also drive the euphoria supporting bull periods. Commentators note that such periods are common and even necessary to provide a continuation of momentum.

Bitcoin’s price above $110,000, combined with previous correction patterns and supply metrics, creates a situation of a market still within its bull construct. Traders eagerly await to watch if this cycle can push to new highs or correct again before making another move.

Related Reading: Metaplanet’s Bitcoin Stash Soars to 20,000 BTC, Becoming Top Global Player!

How would you rate your experience?