- Bitcoin trades above $114,800 with steady weekly gains.

- Analysts highlight long-term cycles over short-term moves.

- Projections see potential highs above $200,000 by 2025.

Bitcoin continues to show resilience in the market. The digital asset is currently valued at $114,847.17 after a 0.99 percent rise in the past 24 hours. Weekly data also reflects a 2.55 percent gain, with prices holding near $114,842.67. This stability comes as investors and analysts weigh short-term optimism against long-term structural cycles that shape Bitcoin’s growth.

Traders remain active as the asset moves through an important phase in its broader cycle. The steady price increase has sparked discussion about the real drivers of Bitcoin’s valuation and where the market could head in the years ahead.

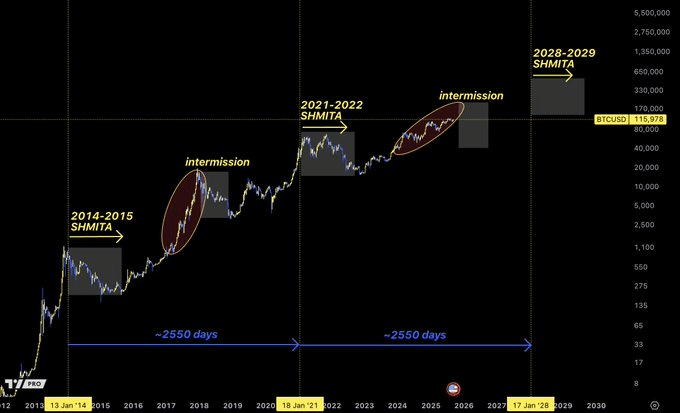

Analyst Highlights SHMITA Cycle as Key to Bitcoin’s Future

Analyst Cristian Chifoi pointed out that time, not price, is the ultimate measure of Bitcoin’s wealth-creation potential. According to his interpretation, market participants expect capital appreciation in one to two years. But such a cycle is much longer and richly rewards patience.

Chifoi also included historical examples, such as 2014-2015 and 2021-2022 as inflection periods of particular importance. He also made a reference to SHMITA year cycle theory, presuming that there might be a critical window in 2028-2029, by about 2,550 days after the former.

In his view, this phase could bring either an early blow-off top followed by a correction or a prolonged distribution period similar to 2021. The analyst also expects a significant reshaping of the altcoin market.

He believes a cleansing period will remove weaker projects, leaving room for stronger tokens to thrive during the next altseason. To prepare, he is keeping 20 percent of his portfolio in cash, ready to re-enter during the intermission before the cycle turns again.

Bitcoin Analyst Projects $200K in 2025 Using Power Curve Model

Another analyst, who went by the name of apsk32, also posed a different view in a power curve. Following Bitcoin’s price in relation to long-term trend structures, he hypothesized that the asset might take a deterministic network-like route. The model gauges how much ahead of time, in terms of being “years ahead,” the current price is relative to the trendline.

Going back to earlier cycles in 2013, 2017, and 2021, there was a cycle of peaks that came every four years in apsk32. Based on this model, in 2025, Bitcoin will hit over $200,000. The model places history’s power curve over deviation so that cycle progression can be seen over what’s being forecasted.

Both commentators emphasize patience and time frames above all else. Using either power curves or cycle models of the SHMITA, there is always a refrain: investors in harmony with longer time frames might make the highest profits.

Related Reading: Bitcoin Ready to Explode: Market Momentum Signals New Highs

How would you rate your experience?