- Sovereign wealth funds are cautiously exploring Bitcoin, but major investment hinges on U.S. regulatory clarity, says SkyBridge’s Anthony Scaramucci.

- Scaramucci suggests Bitcoin could hit $1 million if even one major sovereign fund integrates it into its long-term strategy.

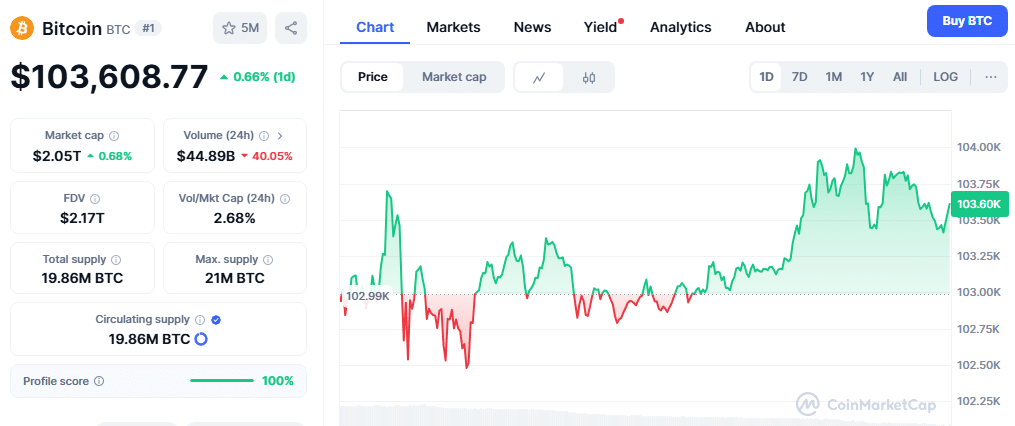

- With Bitcoin’s market cap near $2T, even minor allocations from state-owned funds could significantly impact the crypto landscape.

Sovereign Wealth Funds (SWFs), the globe-spanning investment arms of nation-states, are slowly dipping their toes into Bitcoin. But a tidal wave of institutional capital remains on standby, waiting for one key signal: regulatory clarity from the United States.

That’s the view from SkyBridge Capital founder and prominent crypto advocate Anthony Scaramucci, who believes the real influx of capital is just over the horizon, pending U.S. legislative action.

“I think they’re buying it… on the margin,” Scaramucci said during a May 8 appearance on Anthony Pompliano’s podcast. “But I don’t think there’s going to be a gigantic groundswell of buying until we greenlight legislation in the United States.”

Sovereign wealth funds and institutions are quietly buying bitcoin.@scaramucci explains what is happening 👇 pic.twitter.com/mDLmyE8iaL

— Anthony Pompliano 🌪 (@APompliano) May 9, 2025

The former White House communications director has been vocal about the importance of U.S. regulatory leadership in the digital assets space. In a previous interview with the Financial Times, Scaramucci projected that the U.S. government could introduce crypto-specific legislation by November 2025.

Bitcoin’s $2 trillion Market Cap and Sovereign Wealth Funds

Sovereign wealth funds are among the most powerful financial entities on Earth. These state-owned investment vehicles are typically funded by oil revenues, trade surpluses, or central bank reserves. Norway’s SWF, the largest in the world, manages a staggering $1.73 trillion in assets. China follows with $1.33 trillion, according to Visual Capitalist.

With Bitcoin’s market cap hovering around $2.05 trillion, even a small percentage allocation from SWFs could have seismic implications for the crypto market.

Scaramucci highlights three regulatory milestones that could drive major SWF investment: stablecoin regulation to legitimize dollar-pegged cryptocurrencies, bank custody rules to enable secure Bitcoin holding, and progress in tokenization to allow blockchain trading of traditional assets.

“When that happens, I will tell you there will be large blocks of buying,” Scaramucci emphasized. “People with $10, $20, or $30 trillion under management will be allocating half a billion or a billion dollars into Bitcoin.”

Bitcoin’s Path to $1 Million with SWF Integration

Scaramucci went further, suggesting that if a major sovereign wealth fund formally integrates Bitcoin into its long-term strategy, the crypto could reach unprecedented heights.

“If you want to see a million-dollar Bitcoin, that’s when someone at a sovereign says, ‘Okay, this is part of the infrastructure of the world’s financial services architecture,’” he said.

The idea isn’t far-fetched. ARK Invest CEO Cathie Wood has long projected a seven-figure Bitcoin, recently saying in February that institutional momentum is making that forecast more plausible.

“We think the odds have gone up that our bull case will be the right number because of what is becoming the institutionalization of this new asset class,” said Wood.

As regulatory clarity inches closer in the U.S., many in the crypto industry believe it will trigger a domino effect, paving the way not just for SWFs but also for pension funds, endowments, and traditional asset managers to enter the Bitcoin market at scale.

Related | Ripple Nears Deal as SEC Commissioner Warns of Regulatory Collapse

How would you rate your experience?