- Bitcoin rebounds from recent lows, reaching an intra-day high of $86,500, marking a 7.33% gain in 24 hours.

- Increased spot bids on Coinbase suggest renewed buying interest, with traders debating whether this signals a sustained uptrend.

- Bitcoin’s RSI remains oversold, and analysts warn a failure to break higher highs could extend the downtrend.

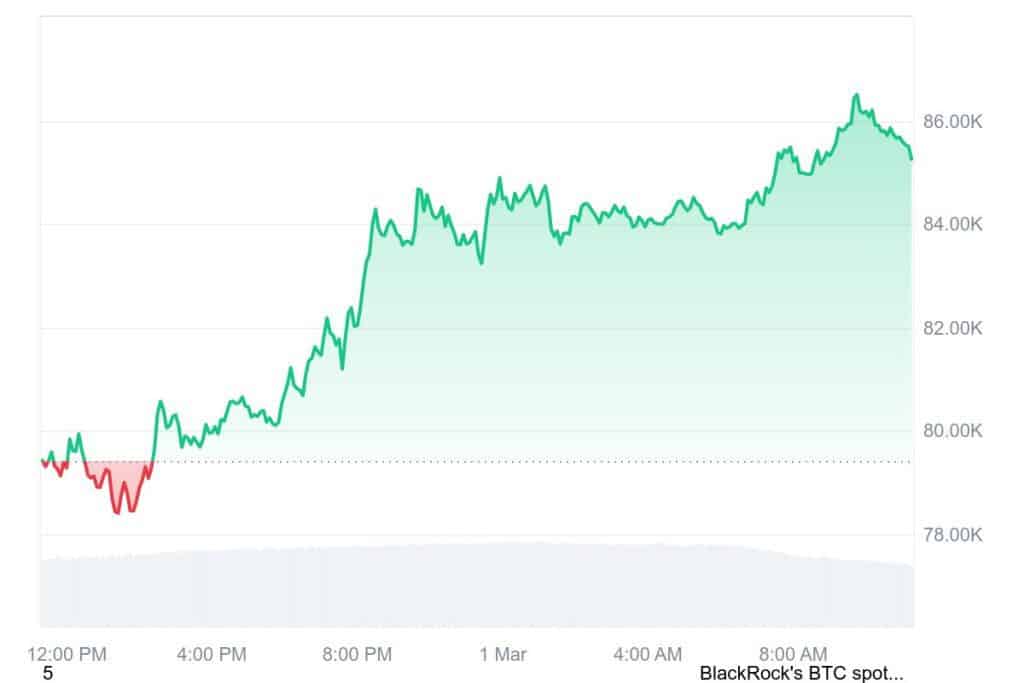

The recent Bitcoin sell-off, which dominated market sentiment for most of the week, appears to be losing steam. BTC has staged a significant recovery, surging back into the $80,000 range and reaching an intra-day high of $86,500.

At the time of writing, Bitcoin is trading at $85,252, reflecting a 7.33% increase in the past 24 hours. The trading volume currently stands at $87.46 billion, while Bitcoin’s total market capitalization has risen to $1.70 trillion.

Bitcoin at Critical Levels Traders Debate Next Move

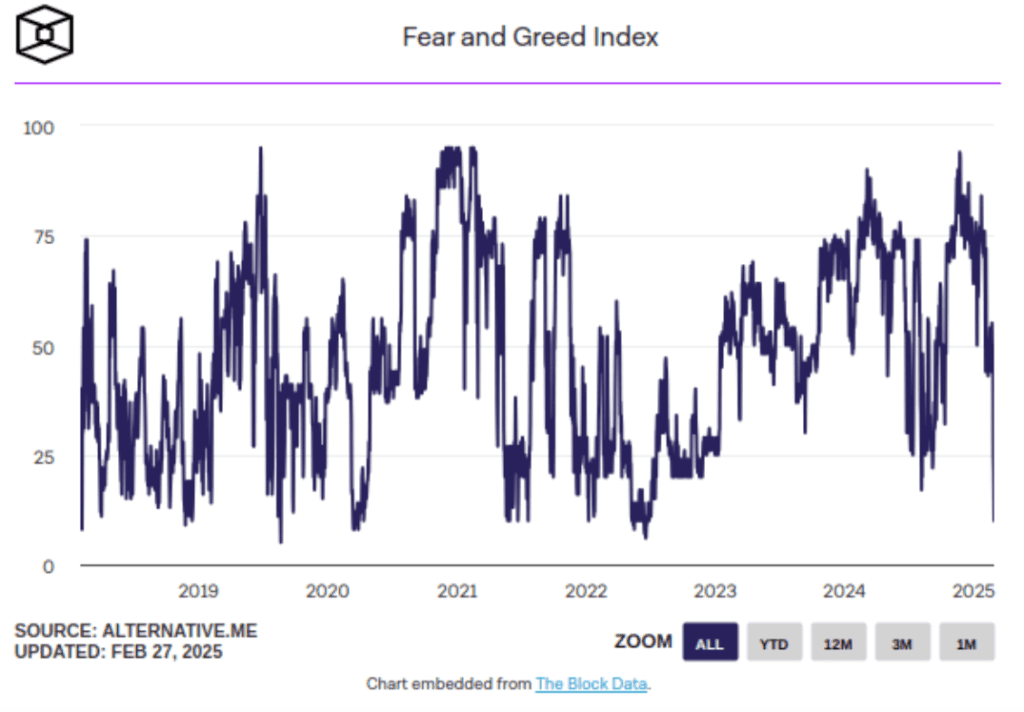

The market players are certain that recent relief in Bitcoin was inevitable since some technical indicators had hit extreme readings. However, they caution if there are no buyers who can sustain momentum or if there are negative macro events, BTC can retest recent bottoms.

JJ, the Janitor, head of options and crypto trading at HighStrike, highlighted a notable shift in market order flow, stating that Coinbase spot bids were “filled,” marking the first instance of bids outweighing asks since Bitcoin’s September bottom at $52,000. This could suggest renewed demand at current levels.

And just like that $BTC coinbase spot bids filled 🎯

— JJ the Janitor (@JJjanitor) February 28, 2025

First flip of bids outweighing asks now since the September bottom at $52,000 https://t.co/XLFWjQd2mG pic.twitter.com/hpiNTO5KPy

Despite short-term volatility, historical data continues to support the view that the recent dip presents a prime buying opportunity for long-term investors. Wintermute trader Jake O echoed this sentiment on X, stating:

For whoever believed in space for longer time frames, today’s disconnect between positioning/sentiment and fundamentals is better than ever. The configuration is similar to August 2024, when the spot dropped below $50K in mass liquidation. Strong, topping out for the next few sessions.

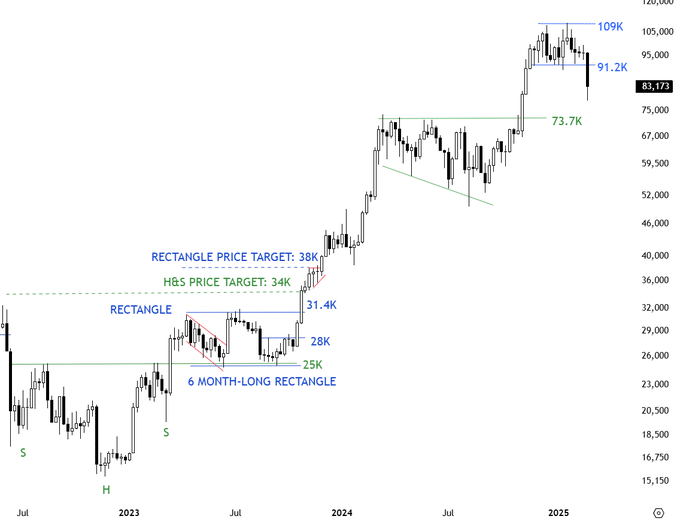

Bitcoin $78K Retest a Turning Point or More Downside

Chartered market analyst Aksel Kibar described Bitcoin’s recent test of the $78,000 level as a “sharp retest” but refrained from declaring a confirmed price bottom.

In a technical context, momentum buyers must know that Bitcoin’s daily RSI is still deeply oversold. As much as today is a good rally, Bitcoin’s daily candle pattern still reflects lower highs and lower lows. A failure at a daily close in the way of a higher high could indicate the current downtrend is far from being concluded.

With Bitcoin remaining resilient at above $85K, market players will be watching to see if and when BTC can form a higher low and continue in its upward trend. A prolonged move past major resistance levels could open the way for optimism again, but volatility is still in play.

With risks and opportunities balanced for investors, the broader crypto market is waiting for confirmation of Bitcoin’s next move.

Related | Bitcoin Miner MARA Holdings Eyes AI Boom After Crushing Q4 Estimates

How would you rate your experience?