- Crypto enters 2026 with cautious optimism and stronger foundations.

- Regulation, institutions, and technology reshape market structure.

- New use cases expand the role of crypto in global finance.

The annual Crypto Market Outlook provides a comprehensive review of trends poised to shape the cryptoeconomy in the year ahead. The report examines price outlooks for Bitcoin, Ethereum, and Solana. It also reviews regulation, token design, and infrastructure changes.

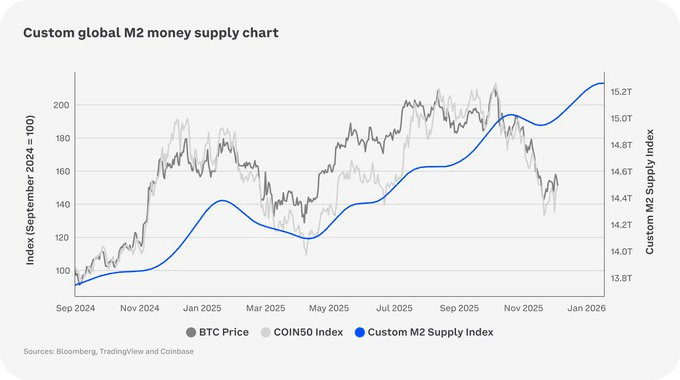

The analysis places strong focus on long-term structure rather than short-term price action. The outlook reflects guarded confidence. The U.S. economy shows resilience despite mixed signals. Rising labor productivity offers support.

Growth slows but does not break. Against this backdrop, the report compares the coming period to a steady expansion phase rather than a speculative bubble. Uncertainty stays high, but conditions favor disciplined growth.

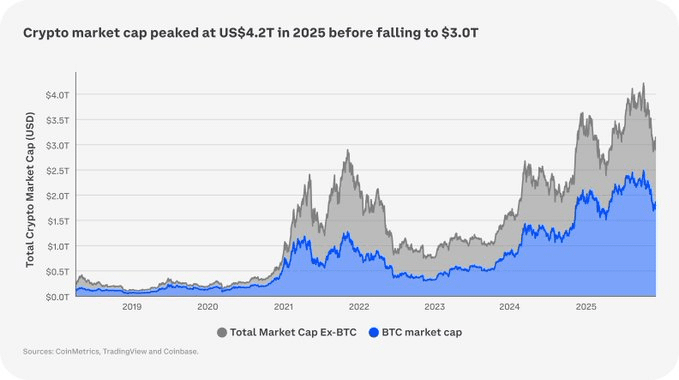

Bitcoin Cycle Still Guides Market Trends

“Bitcoin’s four-year cycle still plays an integral part in market dynamics. In this report, it will serve as a guideline, not a rule. Cycles in the past contributed to market psychology. There could also be the same pattern in the next market cycle, with less volatility.”

Ethereum and Solana are also at critical junctures due to significant upgrades. Ethereum is planning a Fusaka hard fork to upgrade performance and efficiency. Solana is set to upgrade with Alpenglow to prioritize reliability and scalability. Governance is evolving in all major geographies.

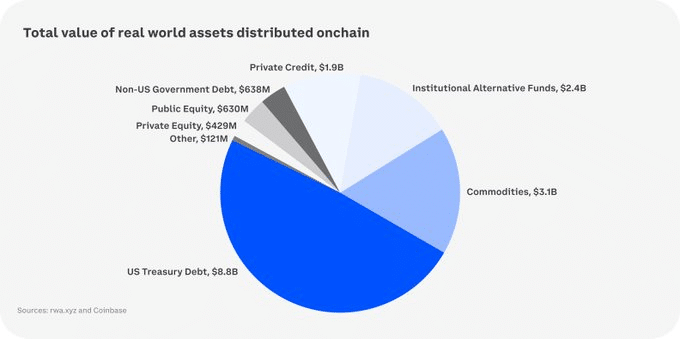

The regulatory environment eases friction for large players. Institutions develop strategies for cryptos with specific risk management parameters. The role of compliance groups is magnified. The standards for custody, reporting, and governance are increasing. The shape of adoption among institutions is also transforming.

The report indicates the trend of moving toward DAT 2.0. This technology not only focuses on the accumulation of assets. Modern companies have now begun to treat block space as a digital commodity. They are investing resources in the areas of trading, storage, and acquisition.

Token economics begins to realign with revenue and cash flow. Narrative tokens become less relevant as sustainable business models attract ongoing capital. The need for privacy increases with the adoption of institutions. Zero-knowledge and homomorphic cryptography emerge. Privacy onchain tools mature. Long-term security planning encompasses the potential dangers of quantum computers.

AI Agents Drive New Crypto Payment Models

The link between AI and cryptography is the use of autonomous agents. For the autonomous agents to operate, there must be open payment channels. Microtransactions encourage endless activity. The new protocols enable agents to control services in the blockchain.

Application-specific blocks are on the rise. The report states that there will be consolidation into a network of connected systems that share security infrastructure, as opposed to multiple systems. The use of tokens for equity offerings is becoming popular due to efficiency.

The crypto derivatives are on the way towards enhanced composability. The perpetual equity markets involve global retail participants. This offers uninterrupted access and the optimal usage of resources. The prediction markets show a rising pattern due to regulatory and taxation reforms.

Aggregators could also be important access points. Stablecoins offer a link to the payment layer. Market value is forecast to be close to 1.2 trillion dollars in 2028. This is through remittance, rewards, and cross-border settlements.

The forecast concludes with integration. Crypto has integration with the overall financial system. This involves execution, regulation, and public engagement. The future for crypto benefits people with good systems for global connectivity.

Related Reading: Is Bitcoin Ready to Hit $300K? Expert Predicts Major Bullish Surge!

How would you rate your experience?