- Crypto-linked trafficking transactions surged 85% in 2025, exposing expanding global illicit networks.

- The Chainalysis report shows major flows into escort, labor, prostitution, and CSAM-linked operations.

- Enforcement actions rose as global agencies disrupted crypto-funded exploitation and abuse networks.

Cryptocurrency transactions tied to suspected human trafficking operations rose 85% from 2024 to 2025, according to new data. The total value reached hundreds of millions of dollars. The findings reflect the expanding use of crypto across illicit global networks.

The figures appear in the 2026 Crypto Crime Report published on February 12 by Chainalysis. The report tracks blockchain flows connected to exploitation-related services. Researchers described the estimate as conservative and warned that undetected activity could raise the real total.

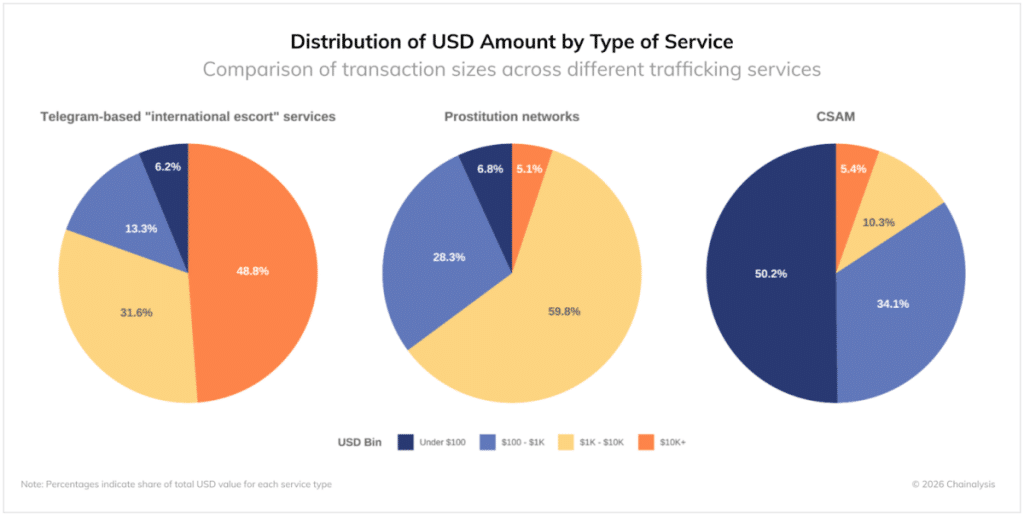

Chainalysis identified four main categories for receiving crypto payments. These include international escort services, labor placement agents, prostitution networks, and vendors of child sexual abuse material. The report states that these groups often overlap with scam operations and money laundering rings operating on Telegram.

Source: Chainalysis

Crypto Payments Expose Scale of Forced Labor Operations

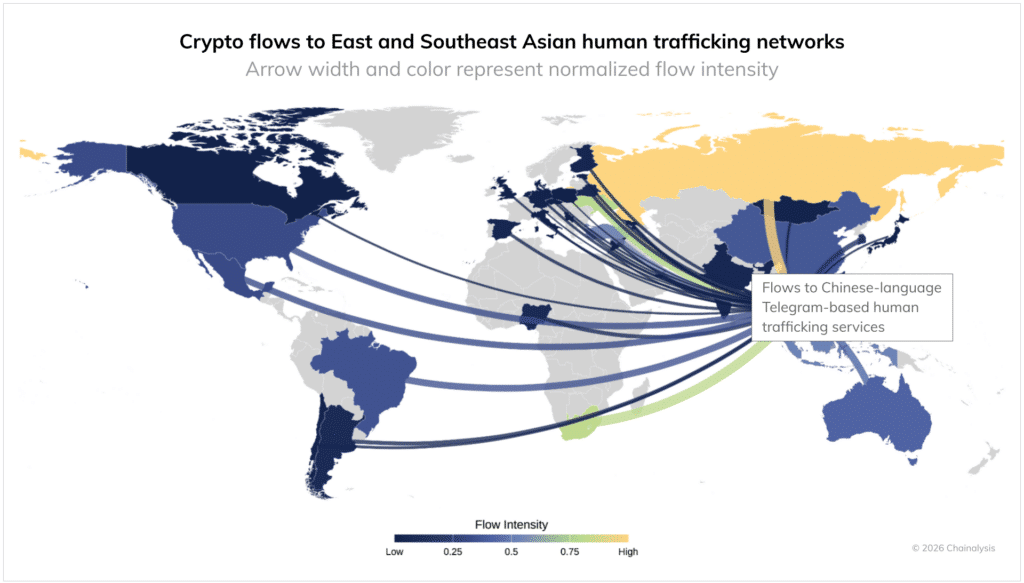

The majority of the traced activities are linked to Cambodia and Myanmar. The report identifies large compounds where victims fall prey to online scams or sexual exploitation. The analysts also identified Telegram-based escort services that offered fixed price structures.

The prices ranged from $420 an hour to over $1,100 for longer sessions. Almost half of the cryptocurrency transactions related to these services were over $10,000. The data suggests organized payment activity.

Source: Chainalysis

Also Read: Sonic Blockchain Refocuses on Vertical Integration to Increase S Token Utilities.

Labor placement agents represent another major category. These actors promise overseas jobs but allegedly trap workers in forced labor schemes. Payments linked to these cases usually ranged from $1,000 to $10,000.

Funds often passed through “guarantee platforms.” These platforms function as escrow systems for illegal transactions. The report connects certain activity to groups previously flagged by the United Nations Office on Drugs and Crime. One named entity is the Fully Light Group, associated with pig-butchering investment scams.

Prostitution networks handled mid-sized transfers. Many transactions fell within the $1,000 to $10,000 range. Some activity blended into online gambling and casino ecosystems.

The report indicates that there has been a shift in the vendors of child sexual exploitation materials. Some of the vendors shifted to other blockchain networks and no-KYC exchangers.

A dark website has collected more than $530,000 since the middle of 2022 through thousands of wallet addresses.

Global Crackdowns Target Crypto-Funded Exploitation Rings

The geographic spread is broad. Funds flowed from the Americas, Europe, and Australia. Countries cited include Brazil, the United States, the United Kingdom, and Spain. The report states that Southeast Asian hubs serve a global customer base.

Enforcement agencies recorded several actions in 2025. U.S. authorities increased arrests targeting consumers of illegal content. International operations disrupted networks such as “KidFlix,” which reportedly had nearly two million users.

The Internet Watch Foundation documented a 7% rise in incidents of child sexual abuse material. It recorded 312,030 cases. U.S. servers, posing as legitimate services, hosted many of these cases and accepted crypto payments.

Chainalysis explains that blockchain technology has the advantage of facilitating quick transactions across borders. At the same time, the system leaves a public record of each transaction made on the blockchain.

The report recommends increased monitoring of suspicious activities related to wallets. The firm says this transparency can help investigators trace flows.

The study indicates that the use of cryptocurrencies is on the increase. It recommends that the tools used to enforce regulations must improve at the same pace.

Also Read: Coinbase Unveils Agentic Wallets, Empowering Autonomous AI Agents to Handle Crypto Transactions

How would you rate your experience?