- Despite inflation concerns and market volatility, Bitcoin has held steady, with large investors accumulating during price dips.

- The LIBRA scandal has triggered skepticism around speculative tokens, leading to a broader shift toward transparency and utility-driven projects.

- Litecoin’s recent surge is fueled by hopes of a potential ETF approval, which could drive further institutional interest in altcoins.

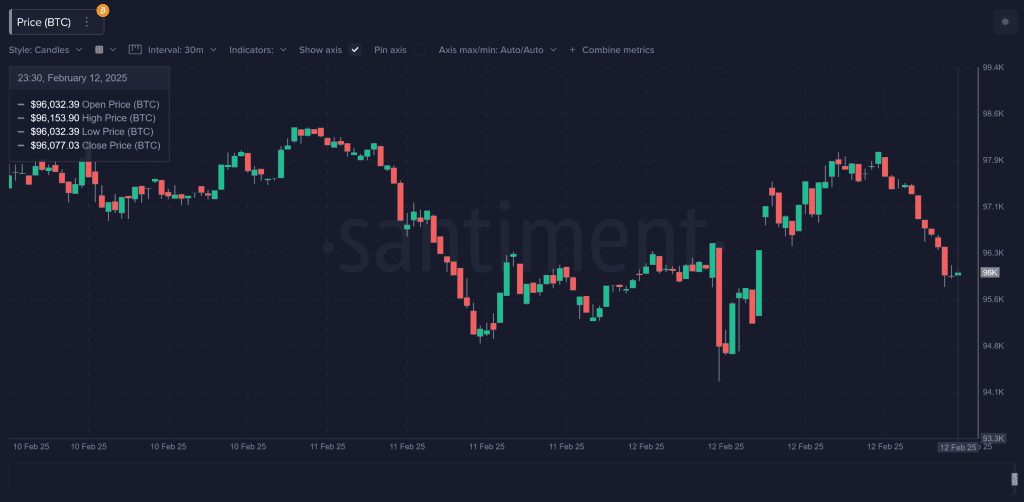

The cryptocurrency market begins another choppy month in the middle of February under the cloud of inflationary concerns and regulator pressure, stifling investor sentiment. A higher-than-anticipated Consumer Price Index (CPI) report shook the market, leaving market participants in limbo about potential Federal Reserve rate decisions, according to report from Santiment. Meanwhile, the fallout from the LIBRA scandal has heightened skepticism about meme coins, and Litecoin’s ETF speculation is driving unexpected market movements.

Bitcoin Holds Ground Despite Inflation Jitters

The release of the latest CPI report caught most traders by surprise.Bitions, reducing the likelihood of an imminent rate reduction. Bitcoin dropped to $94.2K in the aftermath, only to rebound to $98.1K, reflecting economic solidity.

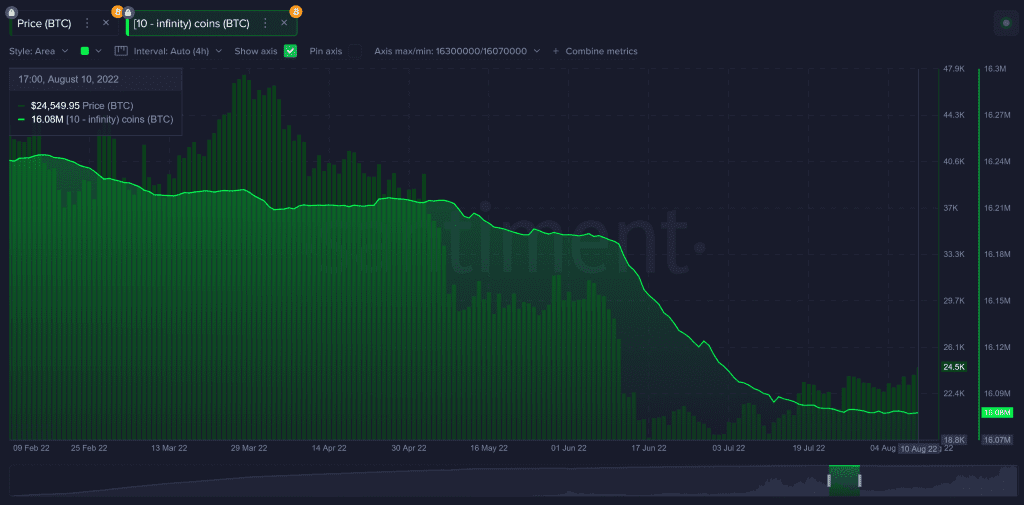

Historically, inflationary issues helped push the cryptocurrency market downward because the market anticipates tighter monetary policy to curb the taking of risks. Yet, the fact that Bitcoin spent most of the year in a tight trading channel implies long-term holders are optimistic. Accoridng to the on-chain data, the so-called whales, the significant investors, to be purchasing Bitcoin during the market downturn in silence, in contrast to the reluctant retail buyers.

LIBRA Scandal Fuels Meme Coin Sell-Off

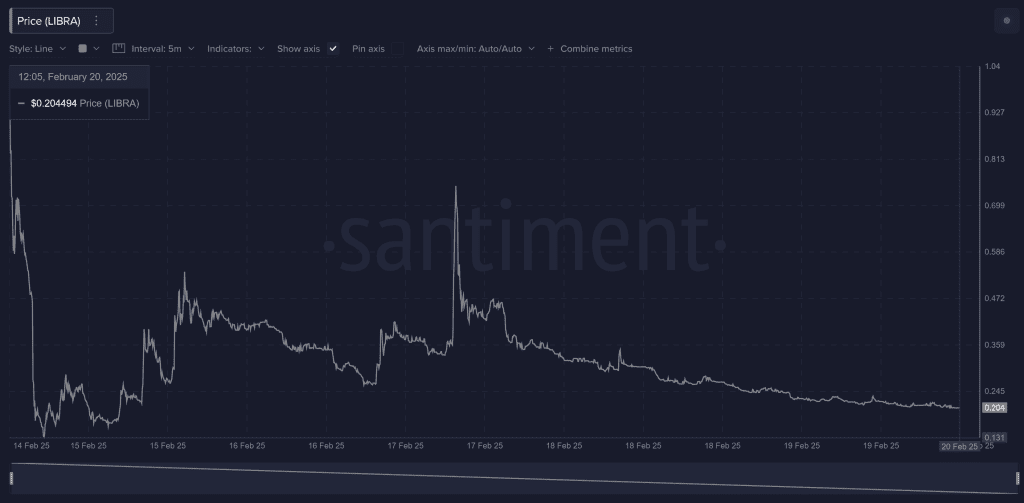

The political and economic implications of the collapse of the LIBRA token further shook the cryptocurrency market. The token first saw a dramatic surge in price after the support from the Argentine president, Javier Milei. The token’s value declined by 80% in just a few days and the investors faced tremendous losses.

Accusations of political manipulation and fraud also followed, demanding investigations under the law and greater regulation of speculative investments. The experience in the case of LIBRA only added to the concerns about meme coins, many based only in social sentiment and bad fundamentals.

Discussions around meme coin investments are in the downward trend, and the market calls for greater transparency and accountability from newer projects. However, some meme coin communities are attempting to build trust by developing real-life utilities and governance models.

Litecoin ETF Speculation Fuels Silent Rally

While major cryptos have exhibited mixed trends, the under-the-radar performer among them has been Litecoin. The asset rose 46% between February 2 and February 19, based on the hope of a potential Litecoin ETF. The U.S. Securities and Exchange Commission (SEC) is considering a spot Litecoin ETF filing, and if the approval is granted, the floodgates could be opened to wider institutional adoption.

Conclusion:

Despite ongoing volatility, some significant metrics point to long-term gain by the institutionally-driven. Bitcoin’s solidity, exchange reserve declines, and the increase in network activity are all indicative the market may be laying the foundation to support future growth. Even if near-term volatility endures, long-term-driven investors may see promise in the realignment of the cryptocurrency market.

Related Reading: SEC Establishes Cyber and Emerging Technologies Unit to Tackle Digital Misconduct

How would you rate your experience?