- BlackRock has filed to enable Ethereum staking in its spot ETH ETF.

- ETH outperformed BTC and SOL over the past week, rising 21%.

- Record ETF inflows suggest rising institutional demand for Ethereum.

BlackRock, the world’s largest asset manager, has taken a bold step toward deepening its exposure to Ethereum. The firm filed to include staking in its iShares Ethereum Trust ETF (ETHA). The Nasdaq submitted the request to the U.S. Securities and Exchange Commission to amend the fund’s structure. This change would allow ETHA to stake the Ethereum it holds.

It would, potentially, transform a passive holding into an income-producing asset. It would also mark a significant watershed event for the ETF market, as it brings together the classical finance business model and blockchain’s core functionality. Staking allows ETH holders to help secure the network and earn back returns as part of the process. BlackRock’s ETF, if approved, would give price exposure, as well as staking returns.

Ethereum Outperforms Bitcoin and Solana

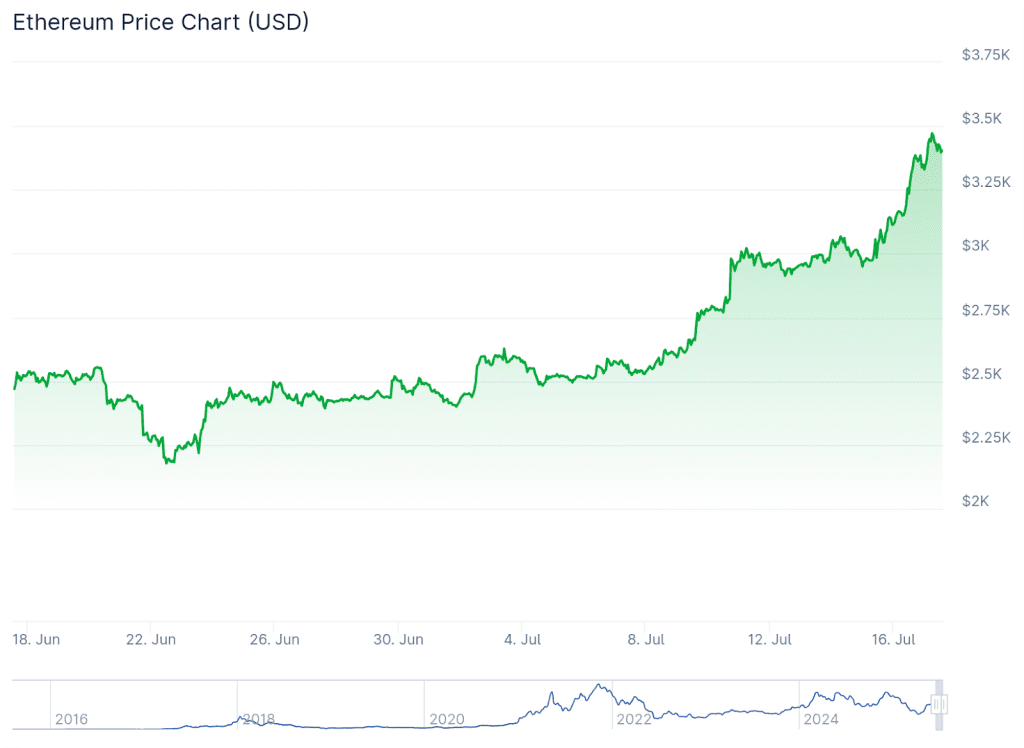

The market has noticed. Ethereum’s price did not react sharply to the filing but already kept ahead of other major cryptocurrencies. ETH has gained 21% over the last seven days. To put that into perspective, the price of Bitcoin rose only 5.5%, and Solana fell behind.

This bullish display regained ETH’s momentum against BTC. ETH/BTC has risen to 0.029, its highest reading since February. Analysts attribute the gain to an unprecedented capital inflows into ETH ETFs. ETH ETFs have seen inflows of over $720 million on July 16 alone. BlackRock fund led the charge with close to $500 million on the day.

Net US spot ETH ETF flows have totaled as high as $6.5 billion. However, Grayscale’s ETHE still sees outflows as part of structural redemptions, pushing the day’s total down. BlackRock’s leadership, however, is an expression of increased confidence that Ethereum has for its long-term value.

SharpLink and BitMine Boost ETH Holdings

Ethereum’s good streak also comes as numerous companies build vast ETH reserves. Companies like BitMine and SharpLink Gaming have built up ETH reserves. BitMine has over $1 billion of ETH, and SharpLink has a treasury of over $500 million. These developments show growing business confidence in Ethereum’s place for the emerging finance of the future.

Although BlackRock’s filing is remarkable, it is far from being exceptional. This year alone, the New York Stock Exchange and Chicago Board Options Exchange have already submitted similar proposals for other issuers of ETFs. Grayscale even attempted to do so on its own last April.

That said, BlackRock’s scale and market influence could accelerate adoption and approval. BlackRock’s long history across traditional and digital assets makes its pitch believable. As institutional players begin to take staking notice, Ethereum can earn a more secure seat at the table of mainstream finance.

Related Reading: Bitcoin Reclaims $120K as Institutions Return and U.S. Crypto Policy Clears Up

How would you rate your experience?