- Ethereum holds near $1,555.56 with slight daily losses of 0.39%.

- Weekly performance remains weak, down 13.73%, despite high trading volume at $19.42B.

- On-chain metrics indicate possible accumulation and a forming price bottom.

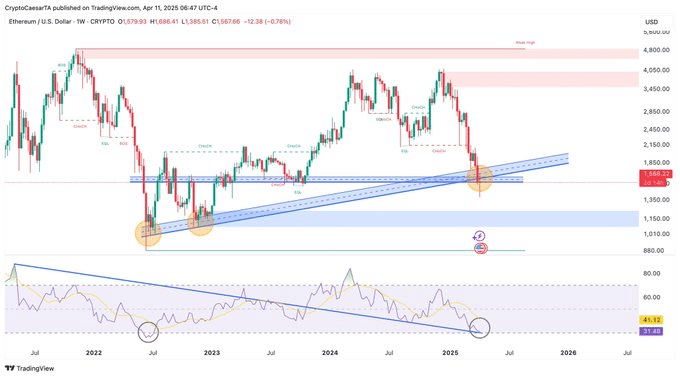

Ethereum’s market performance has drawn concern, confusion, and quiet optimism. At $1,555.56, the digital asset clings to support, slipping 0.39% on the day. Over the week, it’s fallen by over 13%, reflecting deeper market pressure. Yet, not all data paints a gloomy picture.

While declining today, the 24-hour trading volume on Ethereum spiked to $19.42B prior to settling down, showing huge movements. Whales may be repositioning themselves. Smart money tends to arrive prior to when the recovery starts.

Sentiment among investors is still tenuous, with steep falls unsettling retail investors’ hands. Meanwhile, long-term investors are unfazed. Analysts are noting slumber flow reaching record lows, which is an old harbinger of capitulation. When behavior in experienced wallets slows down, the termination of a downtrend is usually on its way.

#Ethereum Entity-Adjusted Dormancy Flow just dropped below 1 million. This historically indicates a macro bottom zone, meaning $ETH might be undervalued and long-term holders are less inclined to sell. It also suggests:

— Ali (@ali_charts) April 11, 2025

• Sentiment is low

• Capitulation may have occurred

•… pic.twitter.com/8mFc3Qdxoy

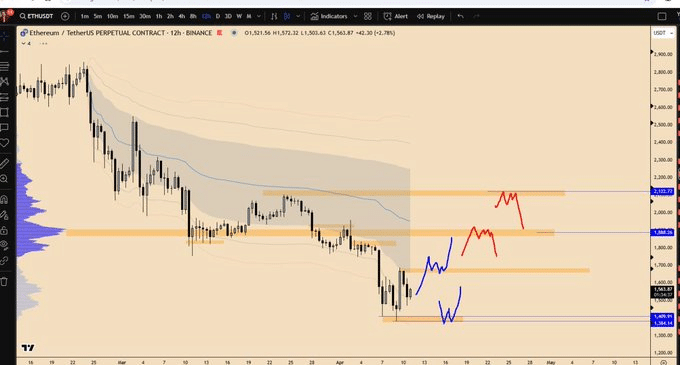

Price Squeezes Between $1,548 and $1,599

ETH currently trades within the narrow corridor of $1,548 and $1,599. Over 1.5 million ETH fall within these ranges. It is now behaving like a pressure cooker. The bulls and the bears are stuck and cannot totally control it.

The lower boundary at $1,461 is emerging as a critical defense. Around 380,000 ETH has been accumulated at this level. If the price slips, this support could soften the fall. Many investors see this as a safety net. Such clustered holdings at key zones suggest quiet accumulation, not panic.

380,000 ETH in play as Ethereum price drops: What's next? $ETH https://t.co/U75NDzS2g3

— U.Today (@Utoday_en) April 11, 2025

Unless a breakout happens above $1,599 or below $1,548, Ethereum’s sideways move may continue. A push above could lead to a quick run toward $2,022 or even $2,809. But if support breaks, eyes will turn to $1,384–1,409 as the next test.

Traders Test Patience as Markets Stall

On the platforms, there is frustration among traders. Some refer to this stage as the “patience test.” Short-sellers are waiting for rallies to come back in. Bulls are waiting for clean breakouts or solid bounces off familiar support.

The $1,500 level is psychologically significant these days too. Losing it once more might trigger more panic. During geopolitical tension and marketwide restraint, Ethereum’s resilience is significant.

While top assets plummet, ETH demonstrates the making of a base. Signs point toward an impending reversal by indicators, with verification still elusive. In the meantime, Ethereum remains in limbo. Investors watch major levels. Momentum accumulates quietly.

Related Reading: Bitcoin Uncertainty and Recovery After Massive Long Liquidations

How would you rate your experience?