- An Ethereum whale awakened after nearly 7 years, moving 2,000 ETH ($3.11M) to Kraken marking their first transaction since 2017.

- The whale originally bought 10,001 ETH at $352, missing the 2021 ATH but still sitting on a ~2,500% gain if fully liquidated.

- Whale transactions on Ethereum spiked 77% in 24 hours, while long-term holders trimmed positions signaling profit-taking amid market volatility.

A long-dormant Ethereum whale has resurfaced after nearly seven years of inactivity transferring millions in ETH to a centralized exchange just as the broader crypto market grapples with heightened volatility.

According to data from the on-chain analytics platform Lookonchain, the early Ethereum investor acquired 10,001 ETH at $352 per token in November 2017, right before ETH’s historic surge toward its 2021 peak. Despite watching their portfolio swell to an unrealized profit of $45 million during ETH’s all-time high of $4,878, the whale refrained from selling until now.

An #Ethereum OG deposited 2,000 $ETH($3.11M) to #Kraken after 7 years of dormancy.

— Lookonchain (@lookonchain) April 8, 2025

This OG bought 10,001 $ETH(cost $3.52M) at $352 in November 2017—and didn’t sell even when $ETH hit $4,878 during the last bull run.

He’s now sitting on a $12.3M profit, but the unrealized profit… pic.twitter.com/mhKm1ywITN

On Monday evening, blockchain data revealed a transfer of 2,000 ETH worth approximately $3.11 million to Kraken, the San Francisco-based crypto exchange. The move marks the whale’s first recorded transaction in over half a decade, sparking speculation across the crypto community.

It remains unclear whether the investor offloaded their entire position, but if they chose to liquidate the full 10,001 ETH stash at current prices, they’d lock in a realized profit of around $12.3 million a far cry from their peak paper gains, but still a staggering return of over 2500%.

Whale Activity Jumps 77 % on Ethereum

This sudden awakening comes at a time when Ethereum is under significant selling pressure. Data from IntoTheBlock shows a 77% surge in whale transactions exceeding $100,000 over the last 24 hours. Simultaneously, ETH held by long-term investors often dubbed “diamond hands” has dropped notably, signaling a wave of profit-taking or loss-cutting.

Sentiment among futures traders is also shifting. According to Coinglass, the percentage of top ETH futures traders on Binance with bullish positions fell from 86% to 79% in the past day, hinting at rising uncertainty and bearishness even among seasoned traders.

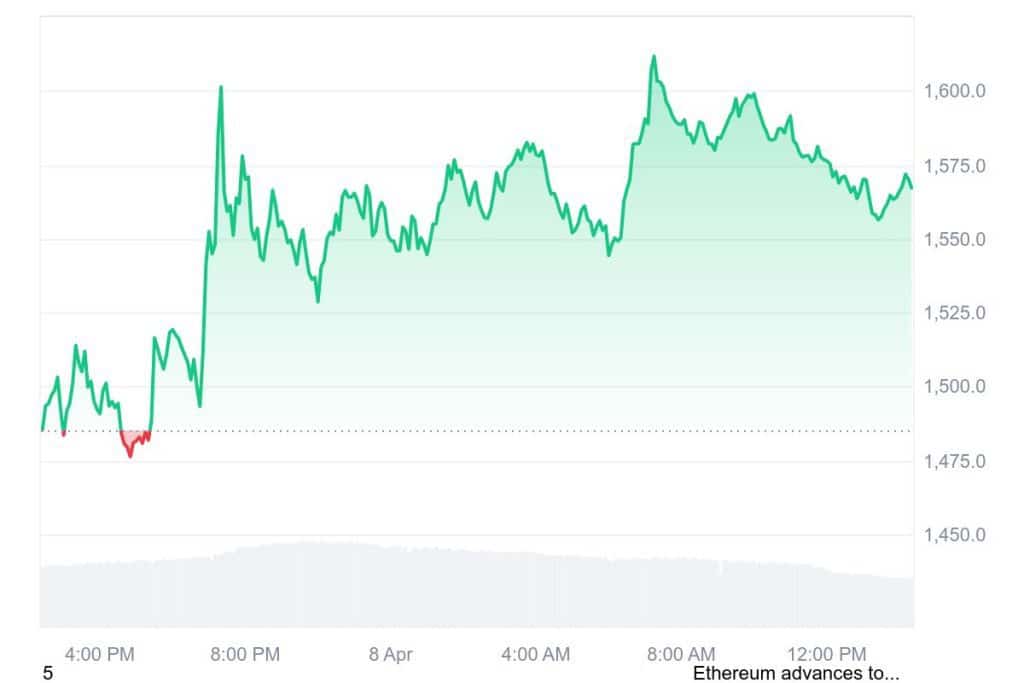

The timing of the whale’s move is particularly notable. Over the weekend, ETH tumbled to lows not seen since October 2023, dragged down by a broader market correction that wiped out billions in market cap across major cryptocurrencies.

At the time of writing, Ethereum is trading at $1,567 with a 24-hour trading volume of $52.63B and a market cap of $189.49B. The ETH price increased 5.50% in the last 24 hours.

This confluence of a macro downturn and whale activity may point to a potential shift in market structure, raising questions about whether other long-term holders could follow suit and exit positions accumulated during earlier cycles.

While one whale’s movement doesn’t dictate the market’s future, it often acts as a signal. With institutional sentiment cooling and retail traders still on edge, the return of an Ethereum OG after years of silence could be an early tremor in a larger wave of activity, bullish or bearish.

Related | Bitcoin Dips to $75K and Bitcoin Pepe (BPEP) is the Meme Coin to Watch

How would you rate your experience?