- Hong Kong’s new stablecoin regulations limit their use in blockchain derivatives, affecting businesses.

- DBS Hong Kong will focus on stablecoin capabilities amid tighter AML/KYC regulations impacting trading.

- China pressures firms in Hong Kong, raising concerns about the future of the stablecoin market.

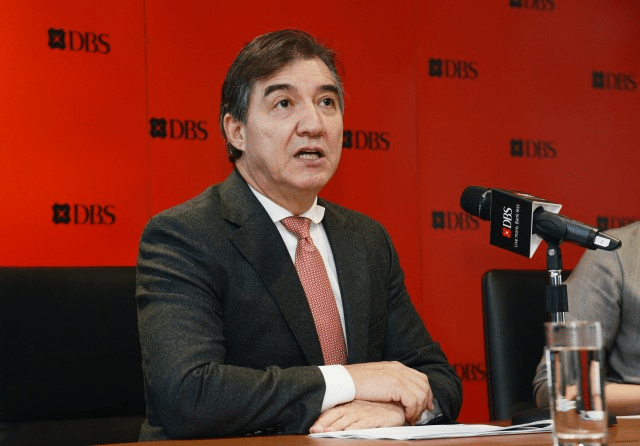

Hong Kong’s new regulations on stablecoins restrict their utilization in the trading of blockchain derivatives. As per a local media report, The Standard, Sebastian Paredes, CEO of DBS Hong Kong, said that more stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations would limit the use of stablecoins in on-chain derivatives. While DBS will manage the situation effectively, the bank plans to focus on the implementation of stablecoin capabilities in the region.

The enforcement of the acquisition of illegal stablecoins by promoting the existence of such devices is the criminal offense that is put into practice on August 1. They also generate an authorized issuer registry.

Opponents argue that the regulations are excessively stringent and will harm Hong Kong’s standing as a global digital asset exchange. Already in Hong Kong, stablecoin businesses have registered huge losses, arguing that the legislative change was criticized more than it was praised.

Hong Kong’s DBS Expands Blockchain Services Amid New Rules

DBS HongKong, a large financial institution, has almost 492 billion assets based in Hong Kong (HK) dollars. It is the biggest bank in Southeast Asia, and its assets stand at $842 billion Singapore dollars ($620 billion). However, DBS continues to be engaged in blockchain technology and the digital asset industry even with the new regulations.

In the previous month, DBS partnered with Franklin Templeton and Ripple to launch tokenized trading and lending platforms aimed at institutional investors. While, the services make use of the XRP Ledger to facilitate safe and efficient transactions. Furthermore, in late August, DBS unveiled tokenized structured notes on the Ethereum blockchain.

Source: The Standard

Also Read: Ethereum Scaling Breakthrough: Fusaka Tests PeerDAS for Secure Data Sharing

China Increases Pressure on Hong Kong’s Stablecoin Market

HongKong’s financial community has been wary of the new stablecoin regulations. It has received a warning that the tougher measures may raise fraud in Hong Kong by the Hong Kong Securities and Futures Commission (SFC). The regulations have sparked worries that companies may be disinclined to seek licenses as stablecoin operators, potentially hindering growth in the industry.

To make things worse, Chinese officials have put pressure on companies in Hong Kong. They have ordered local firms to stop publishing studies or conducting conferences involving stablecoins.

This action is one of the many crackdowns against cryptocurrency activities in China. However, reports indicate that Chinese firms operating on the mainland might face pressure to relinquish any crypto-related activities in HongKong.

These stringent local laws and the external influence of the Chinese have formed an unfavorable climate for doing business in the stablecoin. However, the industry leaders fear the new regulation will deter innovation and make HongKong a less attractive location to launch blockchain and digital assets. The future of the stablecoin market in Hong Kong now seems uncertain.

Also Read: Breaking: Swift’s Game-Changing Initiative Will Revolutionize Global Payments

How would you rate your experience?