- Trump Media commits $500 million to Bitcoin as corporate adoption intensifies.

- Strategy’s Bitcoin playbook sparks copycat moves across the globe.

- Twenty One to acquire 42,000 BTC, becoming one of the largest corporate holders.

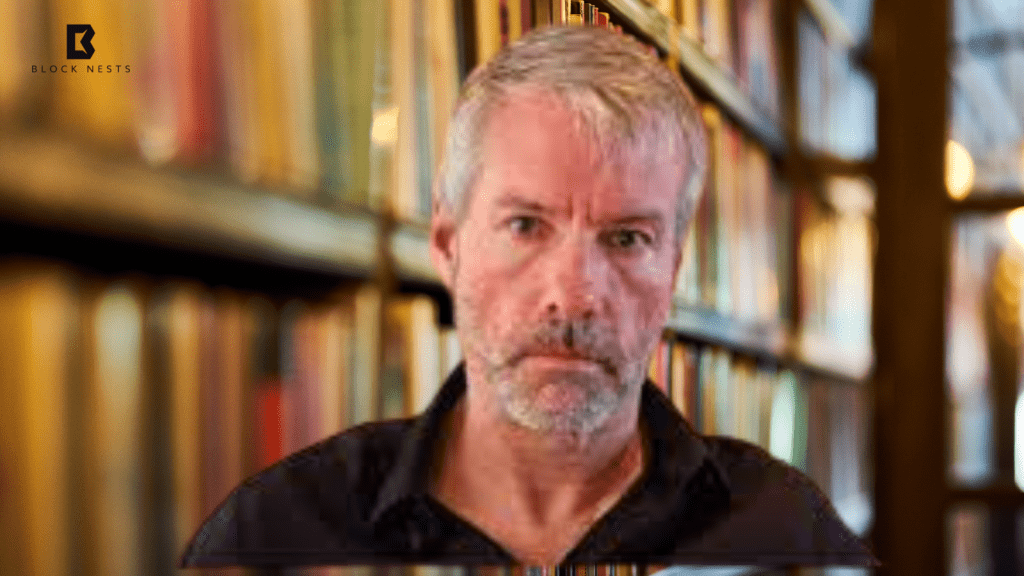

Globally, companies are becoming increasingly interested in Bitcoin because of Michael Saylor’s steely approach to accumulation. The company formerly known as MicroStrategy , now Strategy, has found that business leaders and influential governments now accept its approach centered on Bitcoin.

At the Bitcoin 2025 event, Saylor pointed out that institutional investors are now taking part in Bitcoin more than before. Leaders from several locations, such as the U.K., South Korea, and Hong Kong, revealed they are also following Strategy’s example of keeping Bitcoin on their corporate balance sheets.

Saylor's bitcoin buying strategy is 'exploding' globally, but Wall Street is skeptical https://t.co/NGk4LhyMLW

— CNBC International (@CNBCi) May 31, 2025

Even though the market may fluctuate in the short term, he maintained that keeping Bitcoin is still a smart choice in the long term. Since 2020, maintaining a steady Bitcoin strategy has made Strategy one of the most successful companies in owning the asset.

New companies are entering the market by making strong pledges. Trump Media stated this week that it plans to spend $500 million on Bitcoin purchases. This decision comes as political support for crypto grows nationally in the United States.

At the same time, Tether, SoftBank, and Strike’s Jack Mallers introduced a new company, Twenty-One, for the public to invest in. Through this acquisition, the firm will hold 42,000 BTC and become the third-biggest corporate Bitcoin holder worldwide.

GameStop has also started accepting Bitcoin, though in limited ways. Although Square’s investment is not high, it still suggests that companies are growing more confident in using Bitcoin on their financial records.

Global Institutions and Political Leaders Join Bitcoin Momentum

It’s not limited to private business alone, as President Trump issued an executive order in March creating a Strategic Bitcoin Reserve. According to the plan, the U.S. will not sell its present supply of 200,000 BTC.

This week, Vice President JD Vance discussed Bitcoin with the group, pointing out that it can defend against inflation and concentration of financial control. His statement backs up how critical this asset is becoming in economic and business planning.

As reported by CNBC, the Bitcoin 2025 event started this shift. Under Saylor’s leadership, many existing companies and new firms have started supporting Bitcoin as a reserve instead of using traditional methods.

Michael Saylor’s movements are affecting the way people in business and government consider Bitcoin. When more companies start following Strategy’s actions, we will see widespread adoption of Bitcoin in various countries.

Also Read: Ripple Shakes Up Finance With New Stablecoin as Blockchain Takes Over

How would you rate your experience?