- With an influx of assets bridged from Ethereum, reaching $314 million, Solana’s liquidity and TVL are significantly increasing, suggesting bullish price action.

- Solana faces short-term resistance at $140, but if it breaks above, it could surge toward $178, backed by technical indicators like the 20-day EMA.

- If Solana dips to the $120 range, support at $110 and $90 could stabilize the price. However, failure to maintain momentum might lead to a deeper correction.

Solana (SOL) is still showing strong market behavior, with all the main indicators suggesting a possible breakout. The network circulation of the blockchain is on the rise, backed by sound technical information and improving investor sentiment. All these positive directions are making analysts hopeful about Solana’s future.

Short-term forecasts of Solana suggest it’s bound to hold at $140, but stand a high chance of rallying to $178 because key technical levels suggest a bullish trend. Analysts are particularly bullish, citing recent reports of an enormous amount of assets bridged over to Solana, reaching a record $314 million in the last 30 days. This is an astonishing 463% higher than Ethereum Layer-2 networks.

🚨BREAKING: $314M BRIDGED FROM ETHEREUM TO SOLANA—463% MORE THAN ALL ETH TO L2s COMBINED(30D)!!!🚨 pic.twitter.com/nhtBT8s0Zb

— SolanaNews.sol (@solananew) March 16, 2025

A higher number of bridged assets directly influenced Solana’s Total Value Locked (TVL). This boost in TVL increased its liquidity and prospects for price appreciation. Higher investor demand generally drives higher liquidity, further boosting the potential for bullish price action. Ethereum’s asset migration to SOL reflects growing trust in the Solana network. Many market players speculate that Solana is becoming the leader in decentralized finance (DeFi).

Currently trading at $125, Solana’s price is poised to increase further, with the 20-day Exponential Moving Average (EMA) being a point of resistance. If it crosses above, it will ease selling pressure and pave the way for a rally to the 50-day Simple Moving Average (SMA), where traders anticipate resistance at $178.

Solana Price Outlook with $120 Support

However, if Solana loses its momentum and falls back to the $120 zone, it could undergo further correction. Levels of $110 and $90 could provide decent demand on the downside, keeping the price stable in the event of a decline. A cup-and-handle pattern, which has been forming over months, suggests a potential target of $3,800 if the uptrend holds.

At a larger level, Solana’s network remains active and dynamic, especially as the network is marking its fifth anniversary. This is coming at a time when the network is witnessing a surge in development activity and new entrants in the NFT and DeFi markets, ranging across the retail to institutional investor level. Optimism regarding Solana’s future remains high despite recent market volatility, with many investors expecting better times ahead.

Notably, the refusal of the SIMD-0228 proposal has not ignited considerable negativity. The network’s governance process has been efficient. Continued development of the Solana network could enable faster transaction processing and improved scalability, attracting more liquidity and institutional investment.

Solana Could Surge to $140, Eyes $178 Next

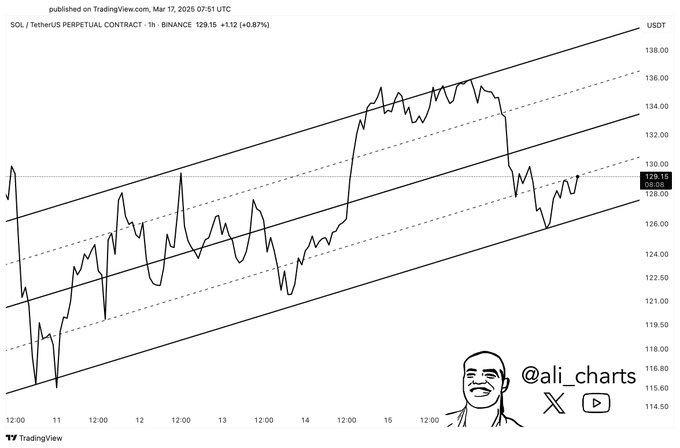

Moreover, crypto analyst Ali Martinez also believed that Solana’s price could first rise to $140 before it encounters further resistance. Based on his chart, SOL is currently trading within an ascending channel, supported at $126 and the resistance level near $140. Should Solana maintain this trend, a break above the resistance could lead the price to $178, adding to the bullish forecast for the token.

As the Solana network continues to grow and attract increasing attention from investors. It remains one of the most exciting assets in the crypto space. It also has the potential for significant price movements in the near future.

Related | Trump’s Bitcoin Vision Takes the Spotlight on Fox News

How would you rate your experience?