- Uniswap saw renewed investor interest after rebounding from a sharp drop to $5.80, now stabilizing around $6.06.

- Spot market activity surged with 3.18M UNI purchased recently and a net buying imbalance of 907K UNI.

- A break above $7.08 could signal further gains, while a drop below $6.00 may invalidate the bullish outlook.

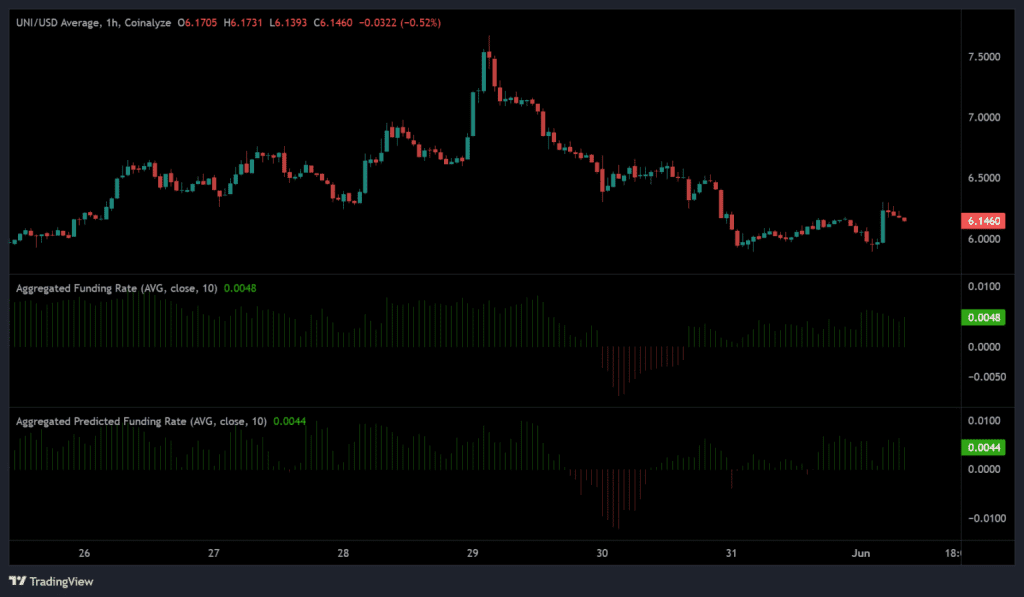

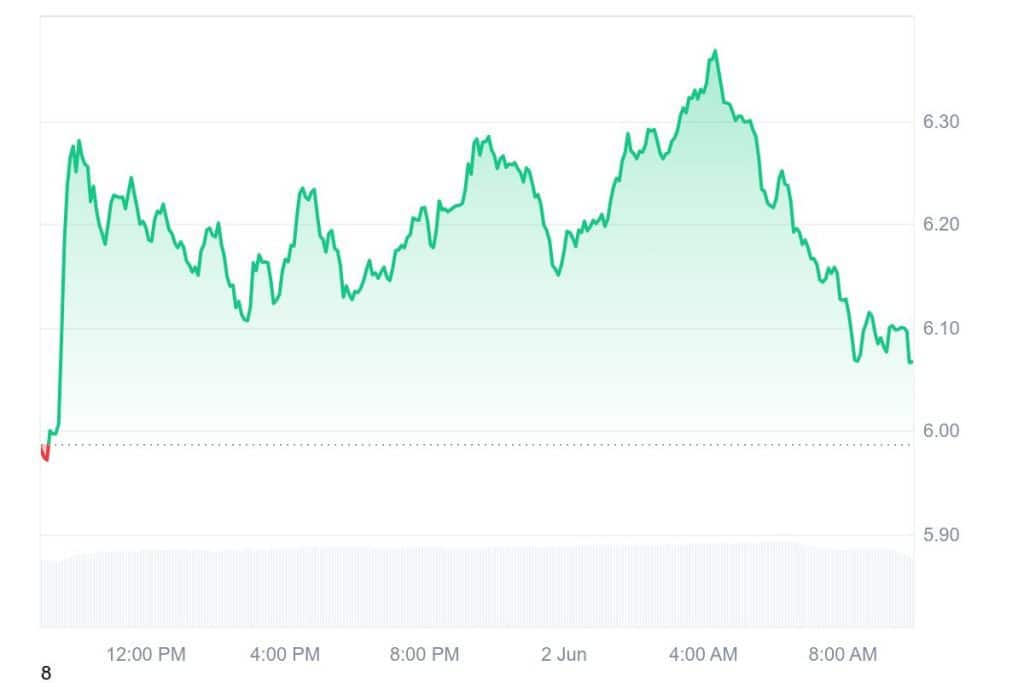

Uniswap (UNI) is drawing renewed investor attention as signs of a potential trend reversal begin to emerge. Just three days ago, the decentralized exchange token attempted to break out of a parallel trading channel, rallying to a local high of $7.60. However, the bullish momentum was cut short, and the token faced a sharp rejection, tumbling to a low of $5.80.

While this price drop might have sparked concern among casual traders, it appears to have been viewed as a golden opportunity by deep-pocketed investors.

Blockchain tracking service Lookonchain reported a significant move that underscores this renewed confidence: a crypto whale acquired 401,573 UNI tokens, worth roughly $2.46 million, directly from Binance. Such a hefty purchase suggests the whale sees current prices as a bargain and is strategically positioning for potential upside.

This isn’t an isolated case. On-chain metrics and trading data indicate that institutional and retail buyers alike are returning to the market. Uniswap’s spot market saw the purchase of 3.18 million UNI tokens in recent sessions, with a net positive imbalance of 907,000 UNI, signaling that buying demand far outweighs selling pressure.

Uniswap Futures Turn Strongly Bullish

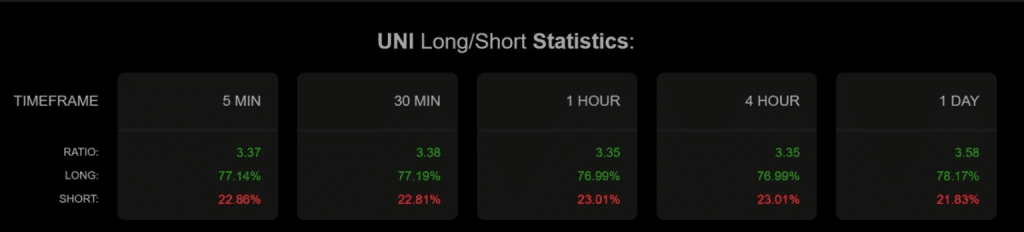

The bullish sentiment isn’t limited to the spot market. In the derivatives space, futures data tells a compelling story. Funding rates for UNI have remained positive over the past 72 hours, indicating that traders are willing to pay a premium to maintain long positions. Current data shows that 78% of UNI futures positions are long, while just 21.83% are short.

Such a pronounced skew in favor of long positions reflects strong market optimism. If this positive sentiment persists, it could translate into sustained upward pressure on UNI’s price, provided the market avoids a long squeeze scenario.

From a technical perspective, UNI has shown encouraging resilience. After dipping to $5.80, the token quickly rebounded to trade around $6.06, supported by increased activity from both whales and retail traders. The $6.00 level is now acting as a crucial support zone.

Uniswap Eyes Breakout Above $7

Should demand continue at current levels, Uniswap could retest previous highs of $7.08 and potentially $7.60 in the short to mid-term. However, traders should remain cautious. A drop below $6.00 could invalidate the bullish thesis and send UNI back toward the $5.70 range.

All eyes are now on the next few trading sessions. If buyers maintain momentum and volumes stay elevated, Uniswap could be on the cusp of a meaningful breakout. Conversely, a loss of demand could signal that the recent bounce was merely a temporary relief rally.

For now, the market leans bullish, but only time will confirm if this marks the beginning of a sustained uptrend or just another fluctuation in UNI’s broader price consolidation.

Related | Ethereum Dips but Smart Money Invests Billions in Quiet Accumulation

How would you rate your experience?