- XRP is nearing a critical turning point based on chart patterns.

- Both bullish and bearish outcomes are possible in the short term.

- Market reaction at key price levels will guide the next major move.

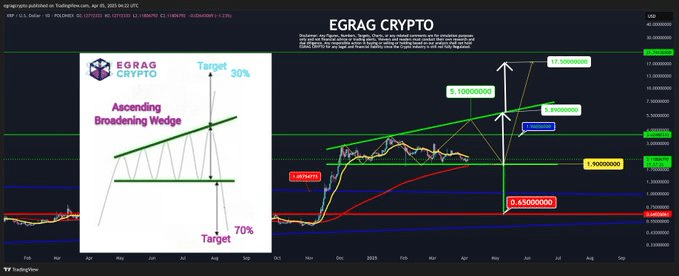

XRP is approaching a key point in its price journey. Market analysts are closely watching a pattern called the Ascending Broadening Wedge. This setup often signals a major price move, but it does not guarantee which direction the move will take. Traders are preparing for either outcome, sharp gains or steep losses.

The initial target in this pattern would be a firm close past $3.50. When the $5 region is approached but fails to close past it convincingly, it might boost the prospects of a pullback. A slide down to $1.90 can follow that. When XRP successfully retests this level and moves upwards again, the route to increasing prices comes into focus.

EGRAG CRYPTO explains the potential in this setup. For him, if XRP finds its way to close above $6, it has the potential to rise all the way to $17.50 in a matter of weeks. However, he warns that the odds are against this happening. A 70% chance of breaking down and a 30% chance of a bullish breakout exist. In the case of a bearish scenario, XRP has the potential to go all the way to $0.65.

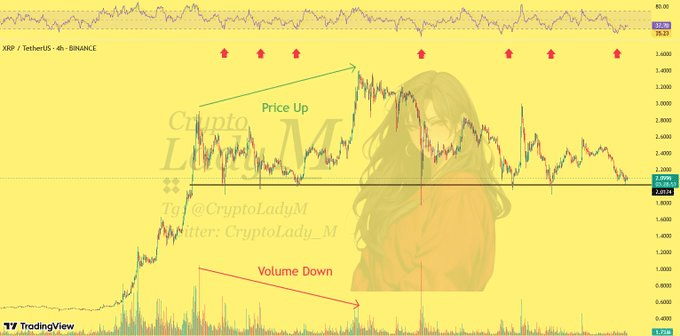

Volume Drop Sparks Debate on XRP Momentum

Other analysts are issuing less ambitious predictions. BlockchainBaller expects to see XRP hit $2.50 to $3.00 by April 2025. He bases this on increased clarity with regulations and institutional interest. He has even quoted more ambitious projections that set the figure of XRP to be $15 in May if market sentiment turns in its favor in a short time.

$XRP could reach between $2.50 and $3.00 by April 2025, driven by favorable legal outcomes and increased institutional adoption

— BlockchainBaller (@bl_ockchain) April 2, 2025

More optimistic targets, with projections of $XRP reaching up to $15 by May 2025

Yeah you heard it right pic.twitter.com/qCLpw5dtYC

Analyst Lady M comes in with additional analysis. She discusses that XRP has just passed $3.39 but experienced a loss in trading volume. Some would interpret this as weakening momentum. That said, dropping volume can also indicate positive rotation in which those who bought in on the first go-round take profits and new buyers buy in on better prices.

Notably, XRP has thus far held in the $2 support area. This has traditionally been a region with significant buying in previous corrections. Metrics such as RSI are also in oversold territory. Historically, these levels tend to support strong bounces, and this is an additional basis on which a near-term upward move can be argued.

XRP’s Next Move Hinges on $5 Level

XRP’s future will be determined by its response to resistance areas in the weeks ahead. Should the asset break through $5 and close through $6, bullish momentum can intensify rapidly. Alternatively, it can lead to a drop back into lower levels if it fails to remain through $5.

This is the critical moment. The XRP community should be on its guard and responsive. This chart pattern is evident enough, but the result is uncertain. Price action will reveal what direction that’s going in.

Related Reading: Bitcoin Blockade: Genius Group Faces U.S. Legal Freeze

How would you rate your experience?