- XRP Tests Blue Channel Support: Analysts Watch for Potential Bounce or Breakdown.

- Closing Above $2.83 May Fuel Rally, Targeting $4.20 in Bullish Scenario.

- Break Below Fib 0.888 Could Signal Decline, Offering Long-Term Buy Opportunity.

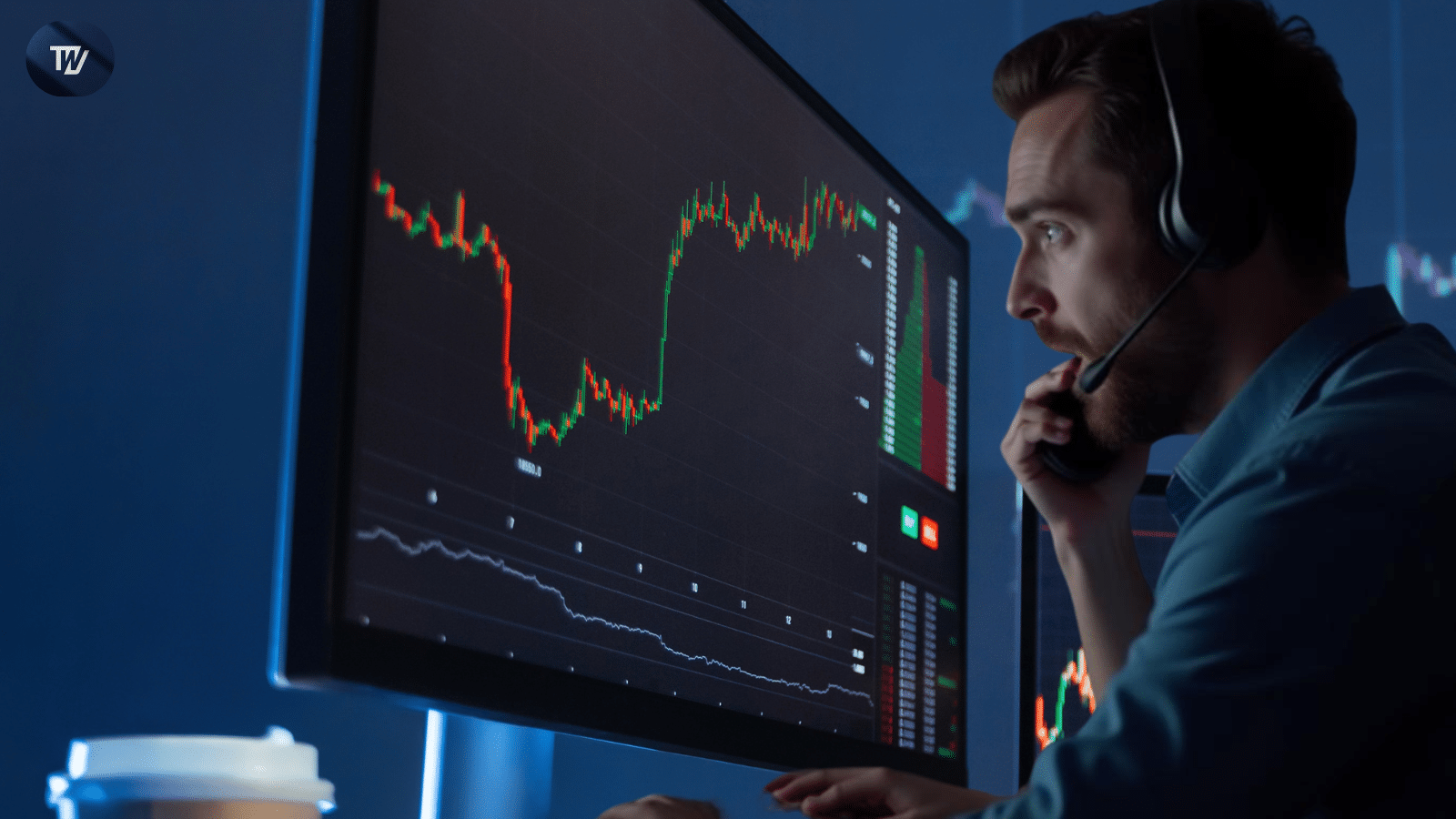

Crypto analyst Egrag Crypto has recently presented a detailed analysis of the XRP chart, specifically, the crypto’s position within Blue Channel. He pointed out that it is now around the bottom of this channel, meaning a short-term bounce might be possible.

#XRP – Today's Price Action Analysis

— EGRAG CRYPTO (@egragcrypto) March 15, 2025

The Blue Channel is providing a clear indication of #XRP's next move.

I've noted that the equilibrium has been established and is resting on the lower edge of the Blue Channel, making a mini bounce quite apparent In the below previous post.… https://t.co/W3FaTyEkSA pic.twitter.com/SSNxBAY2A5

In a bullish outlook, a closing price above $2.83 for XRP will lead to massive profits. This level is consider an area of strength and may open a way towards $ 4.20 though at some point. These could even go up over time and, therefore, give a solid argument for the bullish outlook for the market.

Moving towards a more bearish scenario, XRP may return to the Previous Daily Low (PDL), which is congruent with the Fib 0.888 level. This level indeed provides a good base area, and a breakdown of the level for three or more days suggests bear pressure.

However, if the PDL holds, there are important levels of resistance to look out for. These include the Previous Daily High (PDH) at $2.40 and the Previous Weekly High (PWH) at $2.97, spanning to the Previous Monthly High (PMH) at $3.07. A breakout above these levels will help to increase the level of the market’s confidence in the XRP’s uptrend.

XRP Tests Key Support Levels

XRP may face further crashes if the prices break below the Fib 0.888 level and the PDL indicator. This could lead to a drop toward the Fib 0.786 level, which has the potential to fill the Fair Value Gap. This could be a typical bear trap for the short term, which might present a good buying opportunity for the long-term investor. Nevertheless, when these levels are violate rudely, it may mean the beginning of a more serious bear market that no one expects to see.

Egrag before concluding, noted that the XRP community needs to be united at this period and should not lose hope due to the volatility of the digital asset market. His outlooks help traders understand potential volatility when dealing with the asset.

Thus, it will be decisive for XRP in the short term, which directions it will take during the next few days as it approaches critical levels. Market volatility indicates that traders should pay special attention to indicators such as the support and resistance levels as they plan their trades.

How would you rate your experience?