- Defunct crypto firms still store massive token reserves

- Most assets remain inactive under legal oversight

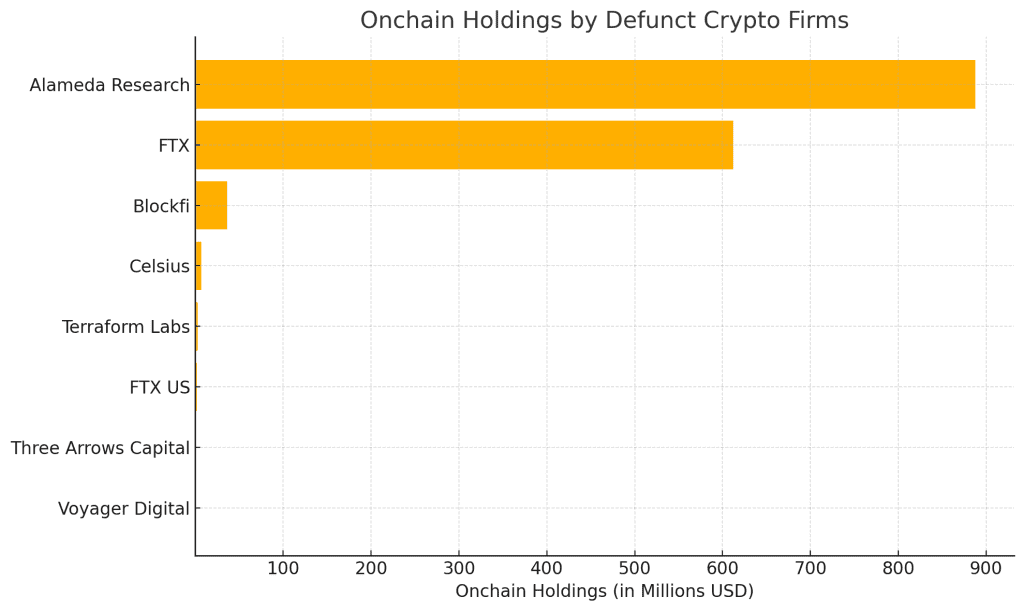

- FTX and Alameda dominate the leftover holdings

The crypto world has seen some high-profile crashes in recent years. These include the collapse of major firms like FTX, Celsius, and Terraform Labs. While their operations have stopped, their digital wallets remain active. These wallets still store large amounts of cryptocurrencies.

They are now under the control of bankruptcy estates and teams appointed by courts. The sum of failed businesses still store assets on-chain and this value is more than 1.5 billion dollars. These funds are in several tokens.

The companies themselves do not have the right to have access to or use them. Concerns and liquidators are those who take care of them. However, the fact that such wealth is in dormant wallets indicates how valuable assets still remain within the crypto ecosystem.

FTX Assets Include Bitcoin Reserves

They are the prominent holders of crypto-assets in this case. The current value of assets held in FTX wallets totals over $611 million. Most of these holdings are in the OXY and FTT tokens. It is interesting to note that while the price of FTT (the token intricately bound to FTX) continues to fall, it can still be traded for about $0.90 on markets today after this platform’s liquidation process took place last year.

FTX US has a stake in some coins. It has control over around $1.64 million worth of tokens, with the largest proportion being TRX. Alameda Research still holds approximately $887 million worth of assets. The majority of it is in Solana (SOL), with more than million SOL tokens as total holdings. Others are including $52 million in Ethereum (ETH) and well over million Bitcoin (BTC).

Blockfi owns more than $36 million, with most of it being in Ethereum. Celsius owns about $6.8 million, mostly in SAVAX. Voyager Digital’s holdings on-chain are much less, with only a little more than $42,000 left over. Terraform Labs still owns $2.45m, split mostly between the CVX and GOHM tokens.

Frozen Crypto Tokens Still Remain

For the meantime, these tokens are not altered. Most are under seizure by reason of legal proceedings. Liquidators cannot freely transfer or sell them. They usually do so in order to restore value for creditors and former clients.

But there are a few tokens that continue to change their prices on the market; thus, the asset pool can grow or perish. Although cryptocurrencies may be future-looking, the past is stored in those locked wallets.

The fact that they keep existing tells you how quickly the tables can turn in the area of digitized finance. As these bankruptcies are being resolved by courts, it is still unclear what will happen to this 1.5 billion dollar asset, but definitely it has not been wasted.

Related Reading: Bitcoin Price Risks Deep Correction as Analysts Spot Repeat of 2021 Pattern

How would you rate your experience?