- Bitcoin is trading at $76,987.82, down 3.51% in 24 hours.

- The biggest long liquidation event of the bull cycle occurred on April 6.

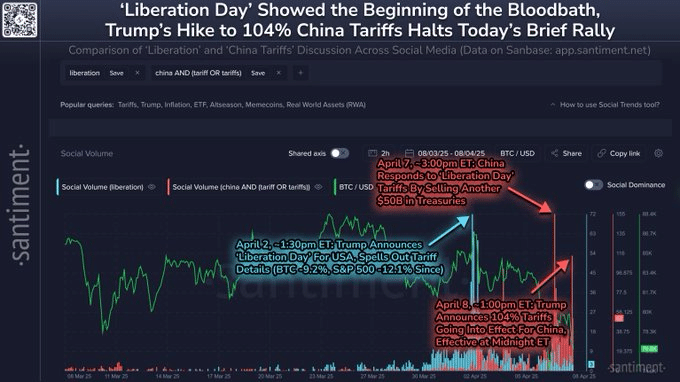

- U.S.-China tariff tensions are amplifying market volatility.

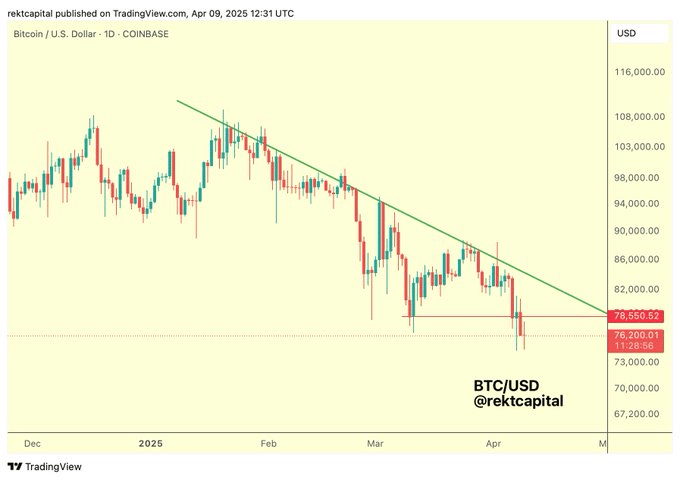

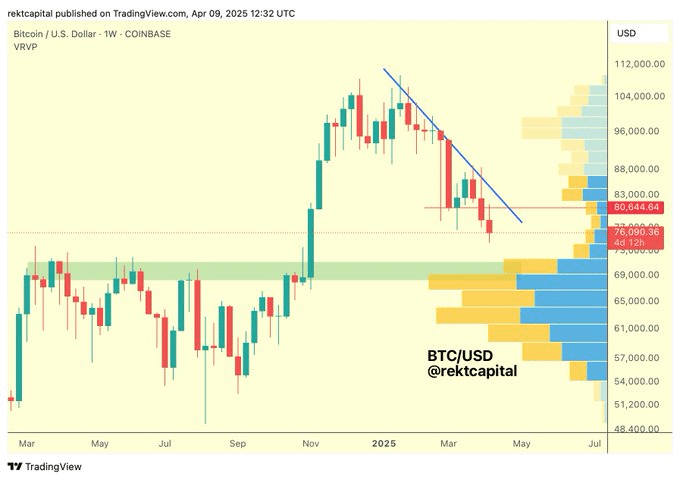

Bitcoin has failed to hold the March lows as support. It attempted to break past the $78,550 mark but quickly reversed. This red zone has now turned into a resistance level. A rejection from here triggered a downward move.

Bitcoin is penetrating further into a region between $71,000 and $83,000, which is an area of high volume with little price interaction. Traders refer to it as a “volume gap,” where price tends to move rapidly due to inefficiency.

Currently, this difference is filling as Bitcoin drops lower. Bulls will have to take out $78,550 in order to regain momentum once again. While this is just a modest intraday reversal, overall, the trend is bearish. The coin has dropped 9.63% in value in the last week.

Bitcoin Volatility Surges as Bulls and Bears Clash

On April 6, longs were dealt a major blow. Approximately 7,500 Bitcoin worth of longs were liquidated in one day. It is the biggest liquidation incident in this bull market. It wiped out leveraged positions in an instant. Bitcoin fell sharply as a consequence, destabilizing market sentiment.

For what reason are there sudden shifts in global economic cues? Market players are responding to policy developments in the United States. Investors are on edge due to Trump’s trade proposals. Abrupt mood shifts have precipitated cascade liquidations. Traders commonly view these events as moments of panic or resets in bullish trends.

Today’s volume is $61.43 billion. Such high volume reflects aggressive placement on the part of bulls as well as bears, as both are reacting quickly. Traders are seeking guidance but cautiously holding on. Volatility is high.

Crypto Slides After Brief Surge to $80K

Bitcoin, as well as conventional markets, fluctuated considerably this week. Bitcoin moved down again after having reached $80.2K momentarily. The S&P 500 made a +4% gain in the morning but ran out of steam. There is no progress in talks on tariffs between the US and China, according to Santiment.

Yesterday, China sold $50 billion in US Treasuries. In response, the US raised its tariff level to 104%, effective shortly. These are ratcheting up economic tensions. Investors are following this closely. Uncertainty is not what markets prefer.

Crypto and stocks will probably be volatile. Until there is seen a clearer policy direction, the prices can keep oscillating extensively. Short-sellers and retail traders remain dormant. Their action may be the next major move if they decide to respond.

Related Reading: Crypto Crash Deepens as Trump’s Trade Tariffs Spark Global Panic

How would you rate your experience?